Gold prices ended Tuesday’s session up $16.92, snapping a two-session losing streak, as stock markets turned lower. Market players sent money back into the safe-haven asset amid renewed concerns about a glut of oil supplies and slowdown in China. In economic news on Tuesday, the Conference Board reported that its consumer confidence index slipped to 92.2 from 97.8 and figures from the Federal Reserve Bank of Richmond revealed that the composite index for manufacturing fell to -4 following last month’s reading of 2.

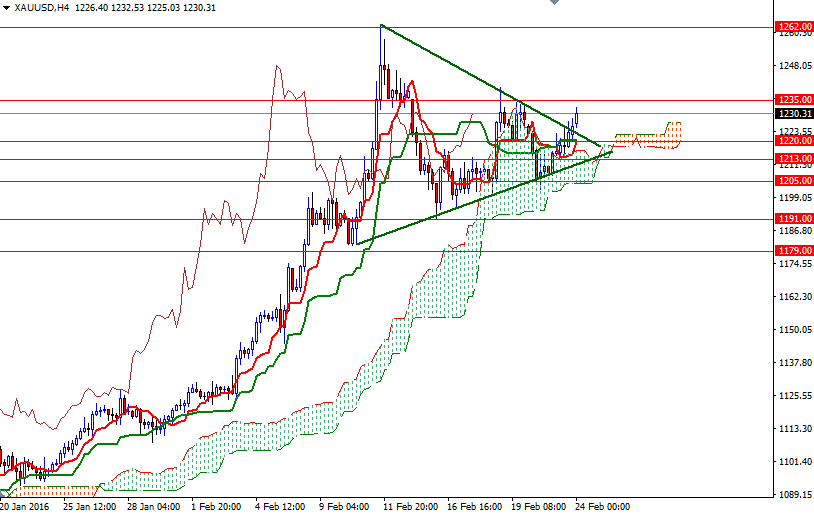

It looks as if the XAU/USD pair finally broke above the upper line of the consolidating triangle (shown on the 4-hour chart). However, the market still has to break through the 12305/0 area which acted as good resistance lately in order to confirm that this bullishness has much further to run. Closing above the 1235 level would imply that the bulls are getting to make an assault to 1250.

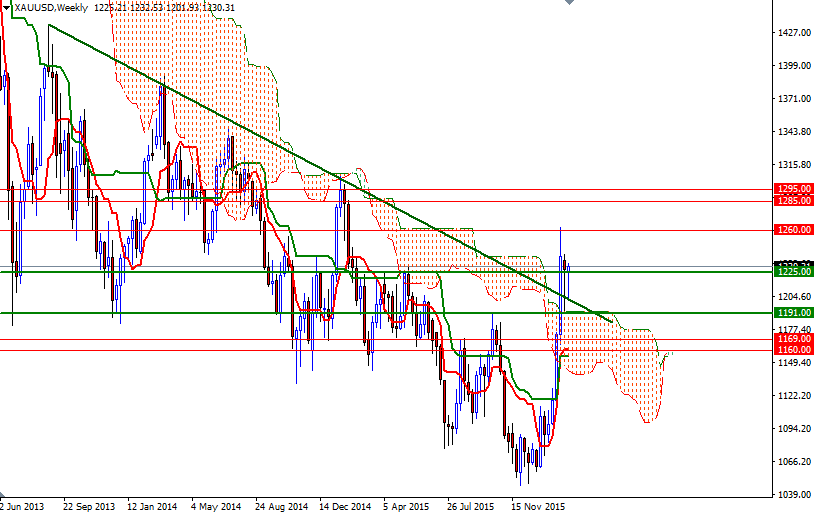

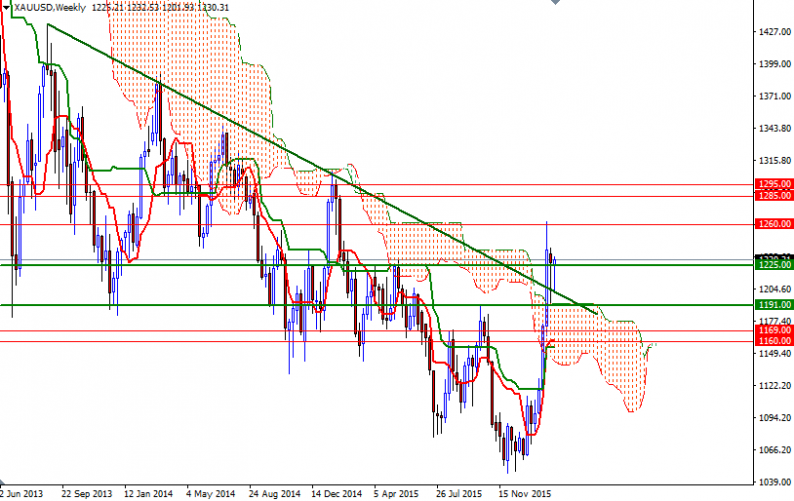

To the downside, the initial support now stands at 1220 where the Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines on the 4-hourly chart converge. If prices break below that, there is also potential support at the short-term bullish trend line. Since a break of this trend line would also drag prices back below the 4-hourly cloud, we could see a fall to 1205/1. A daily close below 1201 would open up the risk of a move towards 1191.

Leave A Comment