![]()

Gold prices may continue to recoup the losses from earlier this week as the precious metal snaps the recent series of lower highs & lows.

The recent price action boosts the near-term outlook for gold as the precious metal regains its footing ahead of the monthly-low ($1261), and bullion may continue to trade on a firmer footing as it appears to be carving an outside-day (engulfing). Keep in mind, fresh comments from Fed Chair Janet Yellen may tame gold prices as Fed Fund Futures highlight a greater than 80% probability for a December rate-hike, and the precious metal stands at risk of facing range-bound conditions should the central bank head show a greater willingness to further normalize monetary policy in 2018.

However, the broader shift in market behavior may continue to unfold over the coming months as Fed officials lower their longer-run forecast for the benchmark interest rate, and the Federal Open Market Committee (FOMC) may stick to the sidelines during the first-half of 2018 especially as Chair Yellen’s tenure is set to expire in February.

XAU/USD Daily Chart

![]()

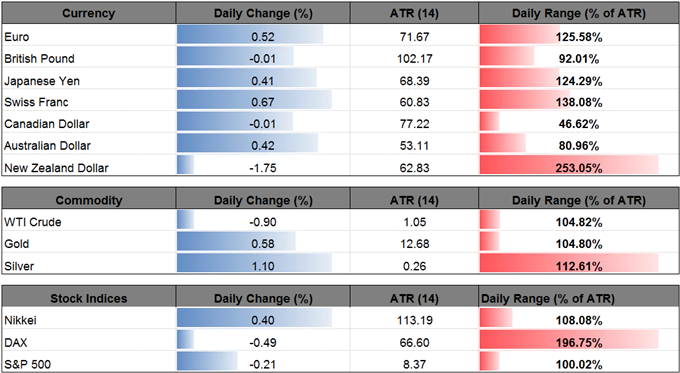

NZD/USD tumbles to a fresh monthly-low (0.7015) as the new coalition government under Prime MinisterJacinda Ardern pledges to review and revise the Reserve Bank of New Zealand’s (RBNZ) primary mandate for price stability.

The change in leadership may continue to produce headwinds for the New Zealand dollar as lawmakers now want the RBNZ to also be accountable for full-employment, and it seems as though acting Governor Grant Spencer will have little choice but to retain the record-low cash rate at the next meeting on November 9 amid the growing scrutiny surrounding monetary policy. With that said, NZD/USD may continue to chip away at the advance from the 2017-low (0.6818) as price and the Relative Strength Index (RSI) preserve the bearish formations carried over from the summer months.

Leave A Comment