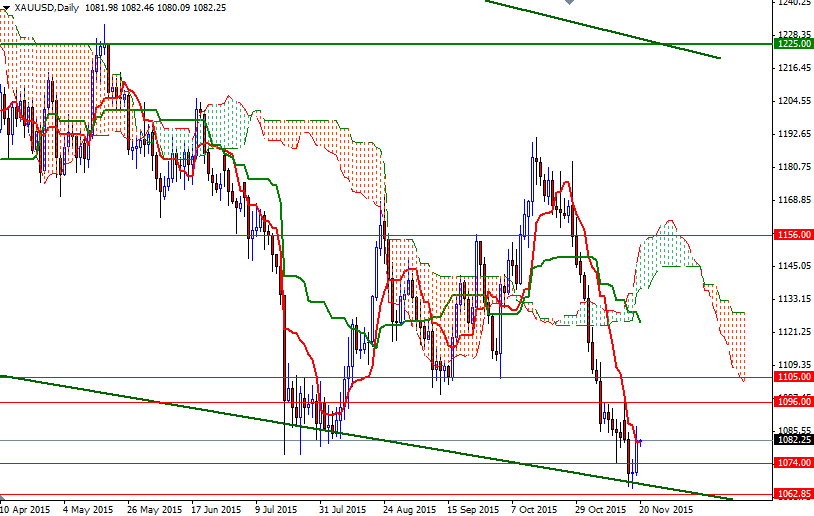

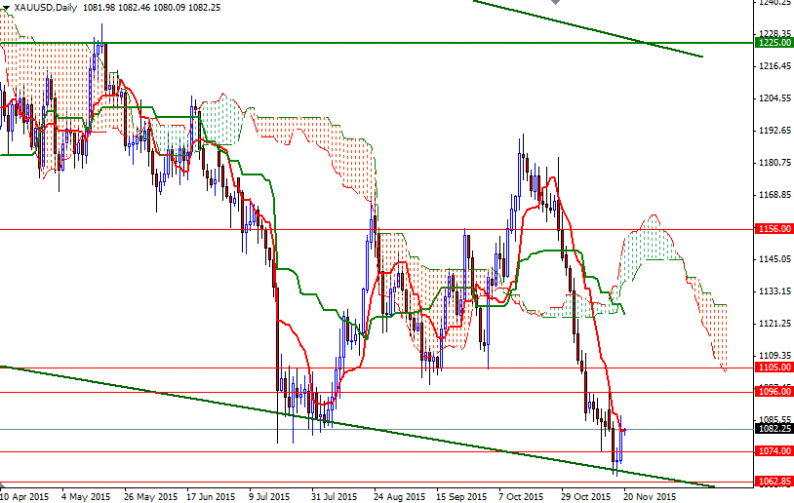

Gold prices rose on Thursday for the second day in a row after touching their lowest level in more than five years as after breaching a key resistance at $1079 triggered some short-side profit taking as expected. The market had fallen relentlessly in the past four weeks on dollar strength and the prospect for higher interest rates. The XAU/USD is currently trading at $1082.25, slightly higher than the opening price of $1081.98.

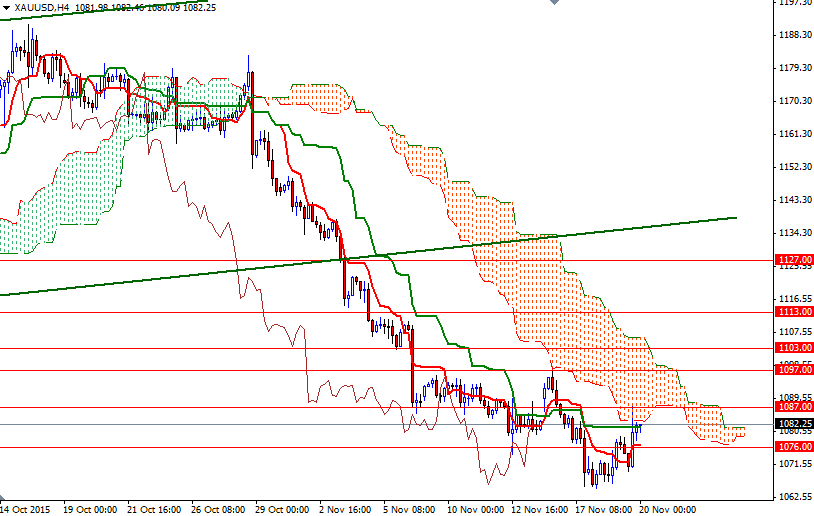

While the broader directional bias remains weighted to the downside, I do not discount the possibility of a push up towards the 1096 (or even 1105) level. The short-term charts are slightly bullish at the moment, with the market trading above hourly the Ichimoku cloud, plus we have positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-day moving average, green line) lines. However, the 4-hourly cloud stands on our way.

As mentioned in previous analysis, the bulls have to push through the 1089/7 region -which XAU/USD encountered resistance yesterday- in order to make an assault on 1096/4. It would possible to see the market challenging the 1105/3 resistance, once that barrier is cleared. On the other hand, any failure to penetrate the clouds may put pressure on the market and drag prices back to the nearby support zone between 1079 and 1076. If this support is broken, it is likely that prices will retest 1074 and 1069.

Leave A Comment