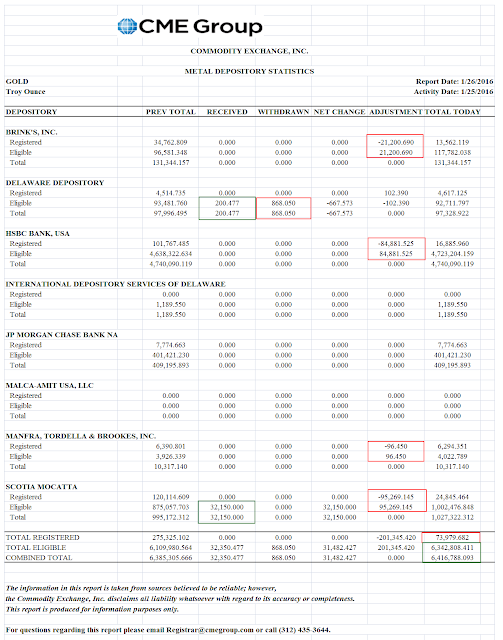

Over 200,000 ounces of gold bullion were withdrawn from the registered (deliverable) category in the Comex licensed warehouses at the least.

That takes the new total down to a little under 74,000 ounces of actual physical bullion registered for delivery at these prices. I will check later but I do believe this is a new low for this century.

Since January is pretty much a non-delivery month for an increasingly non-delivering exchange, it may not mean all that much, but it is interesting to watch for all the reasons we have discussed previously.

And it is a fairly recent phenomenon with no other good explanation that those holding their gold at CME licensed warehouse do not with to hold their gold in a deliverable category at these prices.

Or they enjoy doing useless and pointless paperwork, as some would have you believe.

One should keep an open mind about things. But some reasonably persuasive data to back up the theories from the perennial apologists for the bullion banks would be more persuasive.

When something has not happened before, and other evidence suggests that something has radically changed, I do not think that it is wise to just dismiss it.

This should send the ‘potential claims per ounce’ back towards those highs from the end of last year.

My own theory as you know is that traders who are holding gold in these warehouses do not wish to take the risk of losing it in a physical short squeeze, or have otherwise encumbered the gold and do not wish to risk a delivery and loss of the physical bullion.

There could be another reason for this. I have surely not heard anything remotely plausible yet, just the usual tortured rationales from the perennial bullion bank apologists and creatures of a failing bullion hypothecation system.

Leave A Comment