Gold continues to garner solid global institutional support, and shows great resiliency on every sell-off against the dollar.

Giant bank Credit Suisse has joined the bullish forecasting fun, by raising their price targets for both bullion and mining companies.

Deep-pocketed funds and banks are embracing the world’s mightiest asset with gusto,and that’s apparent in the price charts.

After rallying about $250 towards the 2015 highs of $1307, gold has simply traded sideways in a very orderly fashion.

Investors should cast aside fears about “imminent” and “frightening” price declines, because large banks and powerful hedge funds move vast amounts of liquidity. They are generally unwavering now, in their commitment to gold.

Gold is likely to grind sideways in a rough $1250 – $1300 range until the next big upside catalyst arrives to push it towards my $1350 target.

What could that catalyst be? At the top of the list is another rate hike from Janet Yellen. Her first rate hike caused a massive US stock market panic, and she’s held off on any more hikes since that happened.

Unfortunately for US stock market investors, signs of inflation continue to grow, and I don’t think these investors are listening to Janet’s statements with enough care.

Janet Yellen has clearly stated that oil’s decline is temporary, and that signs of inflation are appearing.

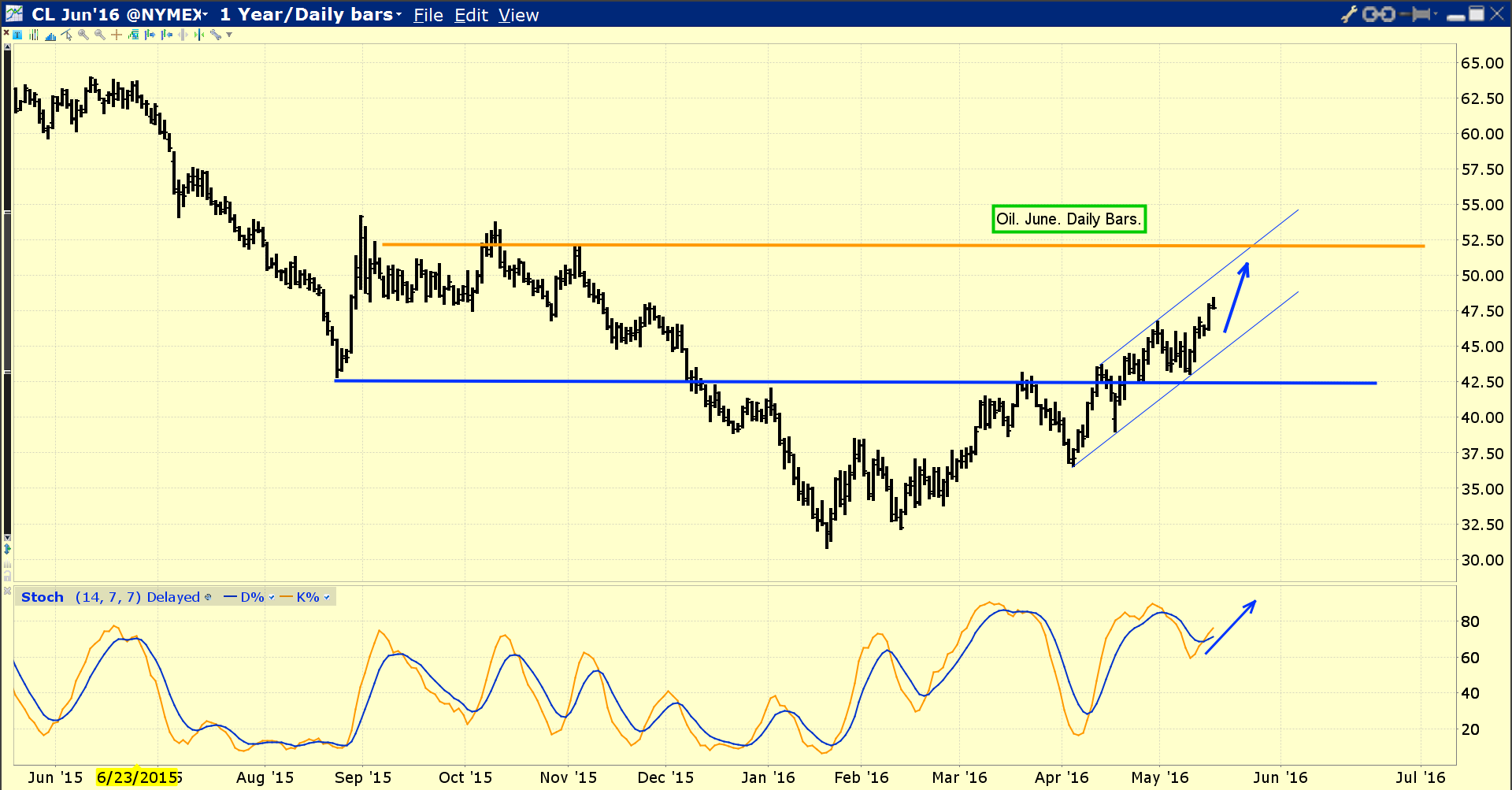

Oil is by far the largest component in most commodity indexes, and now it’s rallying on stronger demand versus supply metrics.

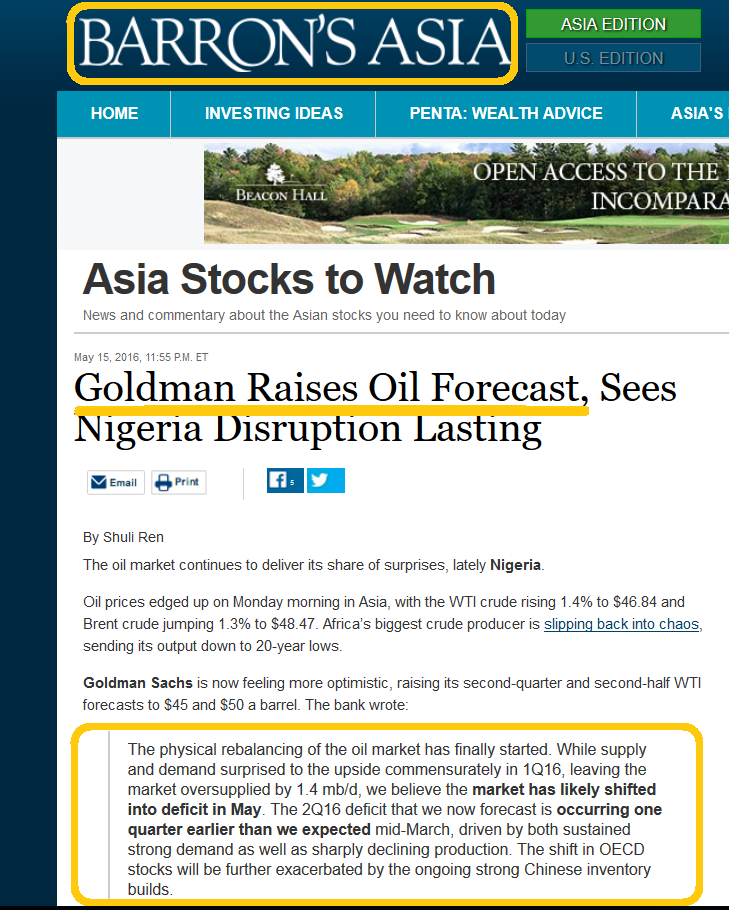

Heavyweight analysts at Goldman Sachs are raising their price targets, and the tone of their statements is very positive.

Most analysts think the Fed is in a bit of a tight spot, whereas I’ll dare to suggest its power is greater than ever. Here’s why: Before the QE “money ball” existed, rate hikes tempered inflation and rate cuts helped create it.

Leave A Comment