Gold prices ended Wednesday’s session nearly unchanged after shuffling between gains and losses following the sharp drop seen on Tuesday. The market continued to digest Fed Chairman Jerome Powell’s testimony that revived fears about more interest-rate increases than expected this year. The Fed is expected to push through the first rate increase of 2018 at its March 20-21 policy meeting. In economic news, the Commerce Department reported that gross domestic product expanded at a 2.5% annual rate in the final three months of 2017 and the National Association of Realtors said pending home sales fell 4.7% in January.

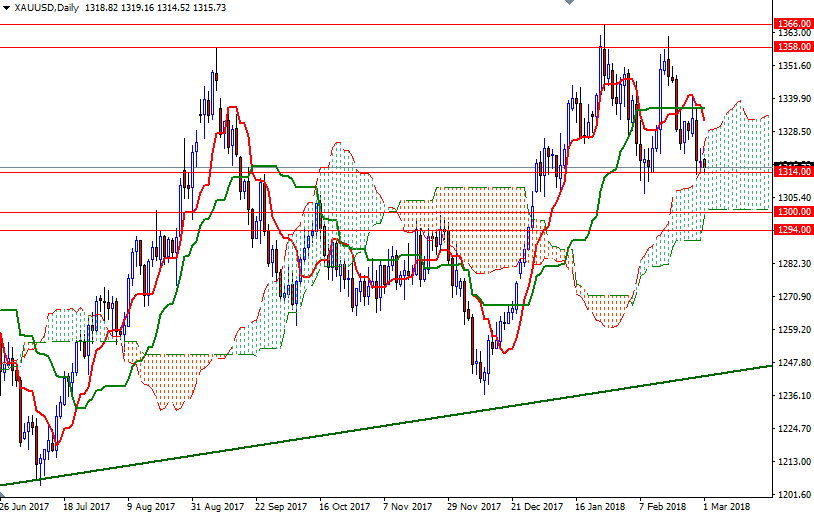

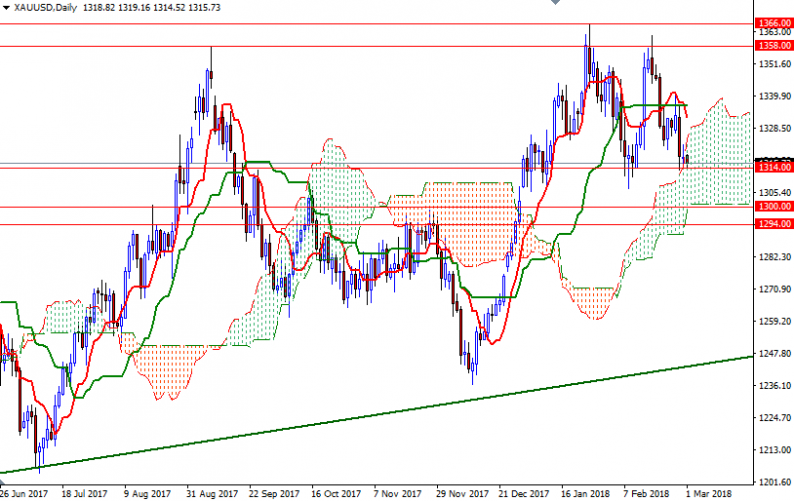

XAU/USD tested the resistance at 1321 as expected but it was unable to break through. Consequently, prices returned to the 1314/2 zone. The market continues to trade below the Ichimoku clouds on the 4-hour chart, suggesting that downside risks remain. Negative Tenkan-sen (nine-period moving average, red line) – Kijun-sen (twenty six-period moving average, green line) crosses on both the daily and the 4-hourly charts support this view.

If the support in the 1314/2 area is broken, XAU/USD will probably visit 1308/5 next. The bears have to produce a daily close below 1305 to tackle 1301/0. To the upside, the initial resistance stands at 1321, followed by 1325/4. The bulls have to convincingly push the market above 1325 to challenge the bears waiting at 1332. A daily close above 1332 paves the way for a test of 1332.

Leave A Comment