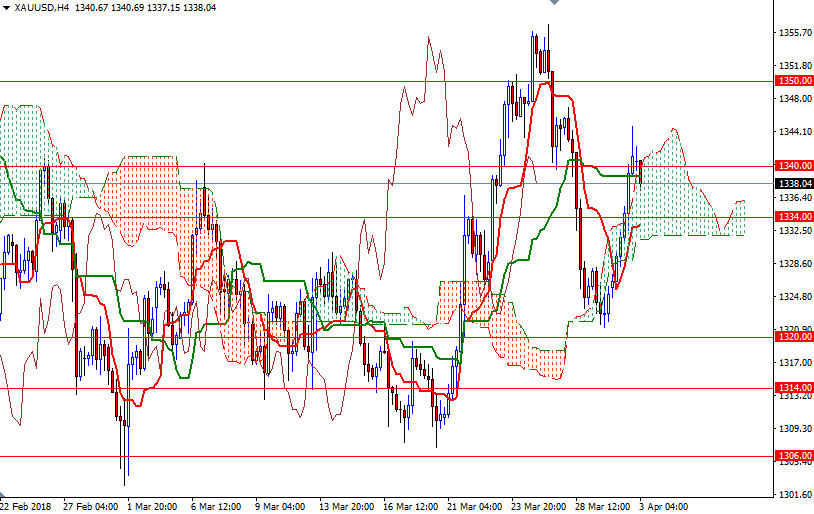

Gold prices rose $15.28 an ounce on Monday as the U.S. dollar and equities weakened after China imposed tariffs on a range of U.S. goods. In economic news, the Institute for Supply Management (ISM) reported that its index of manufacturing activity fell to 59.3 from 60.8 a month earlier. XAU/USD extended its gains after the market climbed above the $1334-$1332 area, but it was unable to pass through the strategic resistance in $1347-$1345. As a result, prices fell back below the $1340 level.

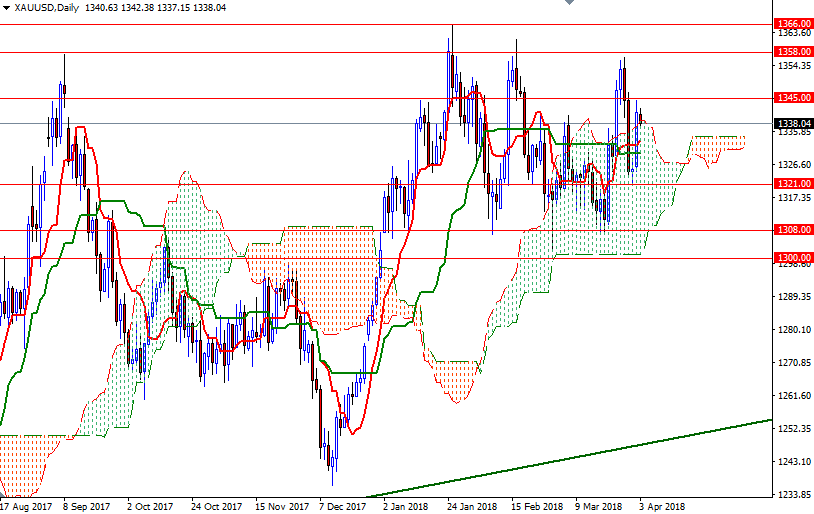

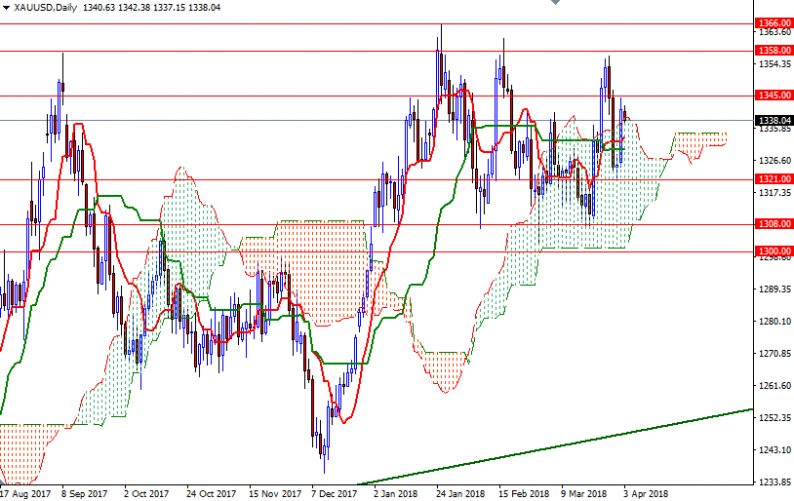

The market is trading above the Ichimoku clouds on the H1 and the M30 time frames. We also have positive Tenkan-sen (nine-period moving average, red line) – Kijun-sen (twenty six-period moving average, green line) crosses on the weekly and the charts. However, keep in mind that prices still remain within the trading range of the past three months.

If XAU/USD gets back above 1340, the bulls will have another chance to test the intraday resistance at 1343. Beyond there the bears will be waiting in the 1347/5 area. The bulls will have to overcome this barrier to set sail for 1352/0. To the downside, the initial support sits in 1337-1336.50, followed by 1334/2 where the top of the hourly cloud resides. If this support is broken, the market will test 1329/8 next. A break below 1328 suggests that the 1325 level will be the next target.

Leave A Comment