Gold prices ended Tuesday’s session up $6.37, posting the first gain in three sessions, as a weaker dollar and tensions between Turkey and Russia buoyed the metal’s safe-haven appeal.

News that Turkey shot down a Russian warplane near the Syrian border helped underpin gold prices but expectations of an interest rate hike by the Federal Reserve in December limited gains. In the latest economic data, the Conference Board’s consumer confidence index came in at 90.4, down from the previous month’s 99.1 and below expectations for a reading of 99.3. The S&P/Case-Shiller index of property prices was stronger than anticipated and the Commerce Department’s report showed the economy expanded at a 2.1% annualized rate, up from an initial estimate of 1.5%

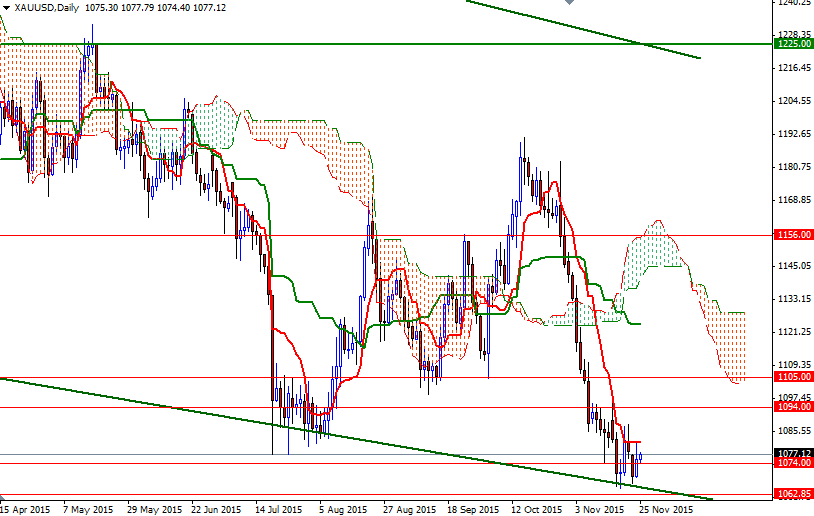

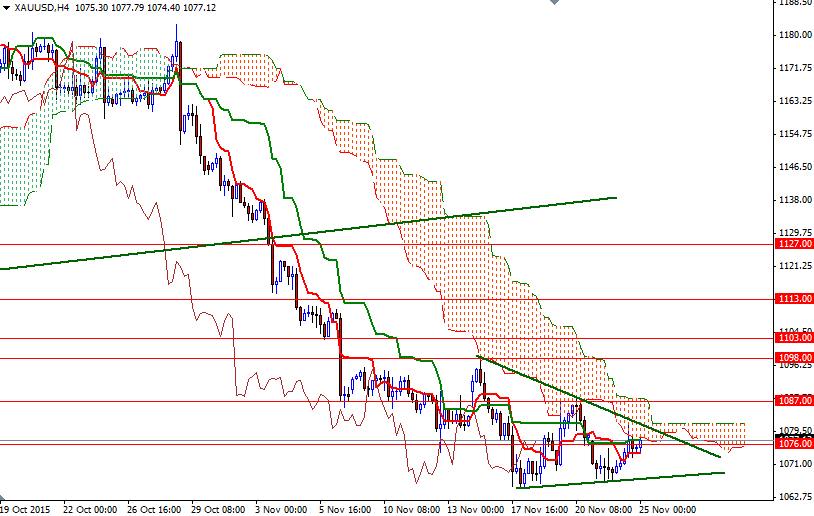

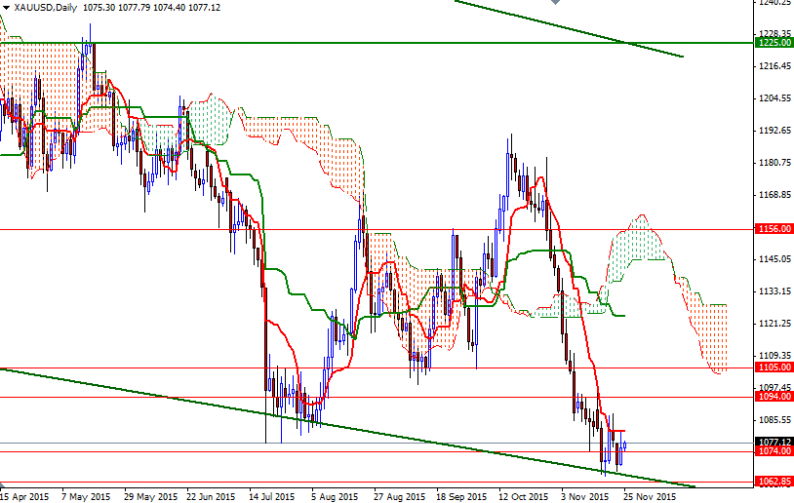

The XAU/USD pair traded as high as 1081.03 before retreating the current levels. From an intra-day perspective, the market has to break through the resistance around the 1181.55 level -where the daily Tenkan-Sen (nine-period moving average, red line) and the upper line of a triangle converge- in order to proceed to the 1089/7 region. Beyond that, the bears will be waiting in the 1198/4 zone.

However, if the Ichimoku cloud on the 4-hour time frame continues to block the bulls’ way prevent prices, the market will eventually return the 1076/4 area. The bears have to drag prices back below 1074 so that they can make an assault on the 1069/6 support. Falling through 1066 would imply that the market is aiming for 1054.

Leave A Comment