The middle class has been stuck in a rut – psychologically if not economically – for years, and they’re not afraid to admit it. Last year’s upset victory for Donald Trump in the U.S. presidential race was a manifest token of middle class angst.Opinion polls have shown that many of the anxieties expressed by the middle class last year are still a concern for them this year. In other words, not much has changed since a year ago. There are some strong indications that the middle class outlook will change for the better in the coming months, however, as we’ll discuss in this commentary.

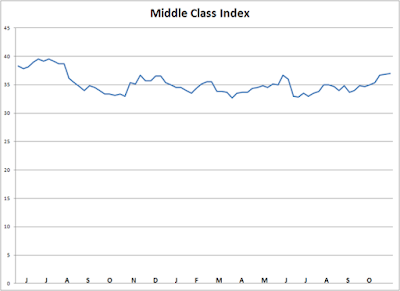

Ask the typical middle class wage earner if they think their economic prospects will improve in the year ahead, however, and you’ll likely receive a cynical response. If there was any doubt that Middle America’s economic prospects haven’t improved much since last year, the following graph will lay them to rest. Shown here is the Middle Class Index (M.C.I.), a share price composite of several leading companies that cater to a largely middle class customer base.The components of this index include JC Penny (JCP), Ford (F), Dollar General (DG), Wendy’s (WEN), Wal-Mart (WMT), and Kroger (KR).

If the above graph is any indication of middle class consumption patterns, then middle income Americans haven’t exactly set the world on fire with their spending. The implication of the M.C.I. is that while middle class spending has certainly increased over the last several years, it has essentially flat-lined on a 3-year basis.While there is admittedly a danger in reading too much into such a simplified overview of middle class spending, it’s likely not far from the truth to assume that middle class Americans aren’t making much progress. At least, that’s how they feel based on the trend of the Middle Class Index.

So the question is, “Will the economic prospects ever improve for the middle class?” While many would respond with a bleak “Never!” there is actually a good indication that the year ahead will witness some solid improvement. Consider the next chart exhibit, which highlights the prospects for the upper middle class (i.e. individuals who earn in excess of $75K/year). The Upper Middle Class Index shown here is a stock price average of several companies which cater mainly to the upper middle, including Target (TGT), Starbucks (SBUX), BMW (BMWYY), Apple (AAPL), and Ruth’s Chris (RUTH).

Leave A Comment