The traditional post jobs report rally for gold is in full swing.

Gold arrived at a key Fibonacci line at about $1268 as the US jobs report was released.

The dollar has stalled against the yen, and that’s also good news for gold.

Gold tends to stage great rallies in the days following the jobs report, and this rally is a particularly interesting one. Here’s why:

First, Trump has ratcheted up his “hawk talk” in regards to North Korea and Iran. He’s scheduled to make a key speechorn Thursday about Iran, a country which is now exporting two million barrels of oil a day.

Second, the Chinese government recently chopped commercial bank reserve requirements. That triggered a massive rally in bank stocks around the world, and in most stock market indexes.

Chinese citizens tend to buy more gold when stock markets are rallying and economic sentiment is positive.

Friday also marked the last day of COMEX gold trading during the Golden Week holiday in China. Chinese gold markets are now open again, and eager buyers are clearly in action.

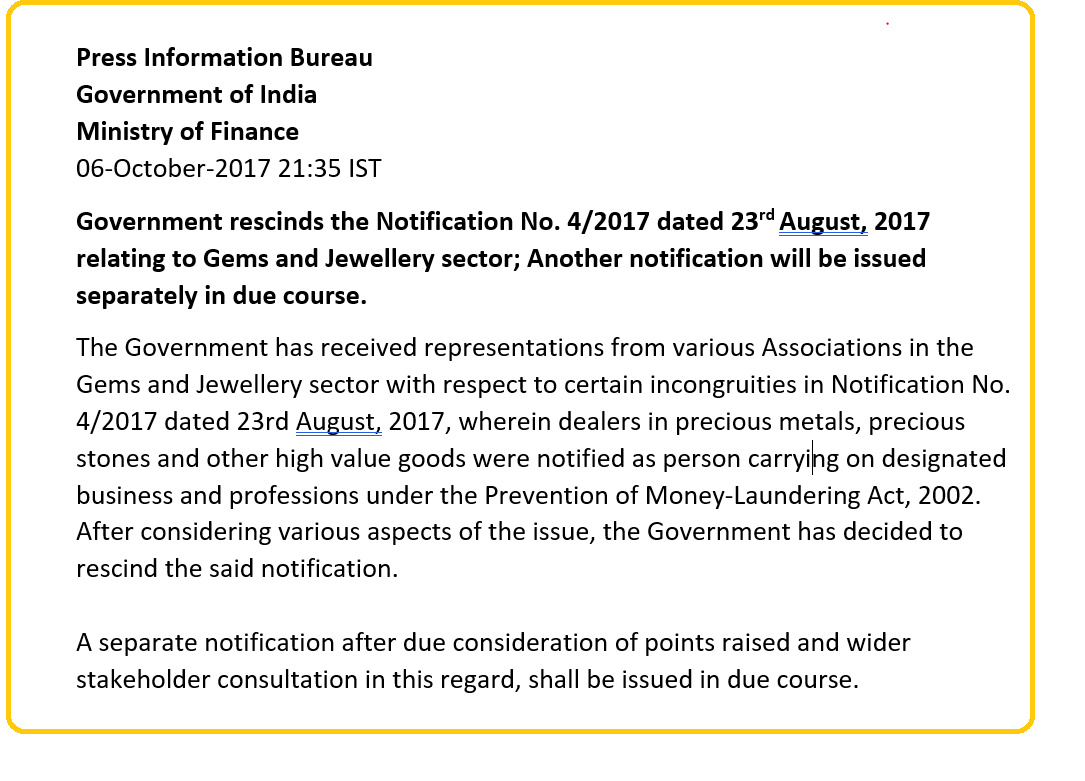

Perhaps most importantly of all, on Friday the Indian government cancelled the “Know Your Client” rule for gold jewellery buyers and that happens just in time for the launch of Diwali.

This is pretty big news for gold price enthusiasts around the world.

Given all of this gold-positive news, it’s pretty easy to understand why gold has bounced so firmly from the $1268 area Fibonacci line.

Fundamentally, there is nothing negative for gold right now. Gold has rallied after every rate hike. It did that in the 1970’s as the Fed Funds rate soared to 20%. The precious metals and the mining stocks soared like a flock of golden eagles as that happened, and 2018 could see that repeated, albeit on a smaller scale.

The Fed has three rate hikes scheduled for 2018, and aggressive quantitative tightening (QT). By December of 2018, money velocity should reverse and begin a long term bull cycle.

Leave A Comment