Gold prices ended a choppy, two-sided trading session slightly lower yesterday, with many investors in wait and see mode ahead of key central bank meetings and economic data. Fed officials will likely decide to hike rates for a fourth time since December 2015 but this is already priced in to some extent. Investors will probably focus more on the economic projections of FOMC members, to gauge whether they will pause or raise rates in September.

Prices are stuck in a range between the 1271.50 and the 1263 levels. We may have to wait for Fed Chair Janet Yellen’s post-meeting press conference before the market makes a meaningful move. Meanwhile, I will be keeping an eye on the aforementioned levels.

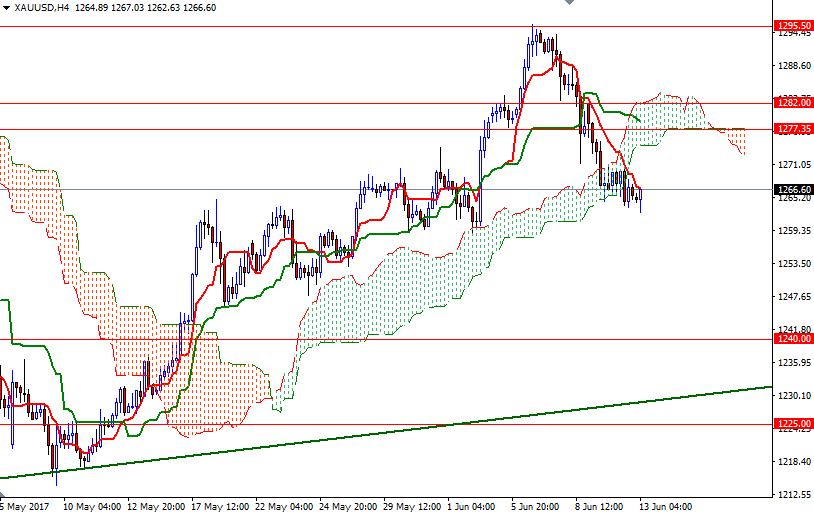

Despite a positive medium-term outlook, XAU/USD resides below the Ichimoku clouds on the 4-hour chart and we have negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines. While these imply that the short-term downside risks remain, the downside potential may be limited until the bears eliminate nearby supports such as 1263 and 1260/59. Breaking down below 1260/59 would open up the risk of a move towards 1254.50. The bears will need to capture this strategic camp to gather momentum for 1250.70-1249. On the other hand, if XAU/USD breaks through 1271.50, then prices may head towards the 1277.50-1275 area, where the bottom of the 4-hourly cloud sits. A break up above there suggests that the bulls will be aiming for 1283/2.

Leave A Comment