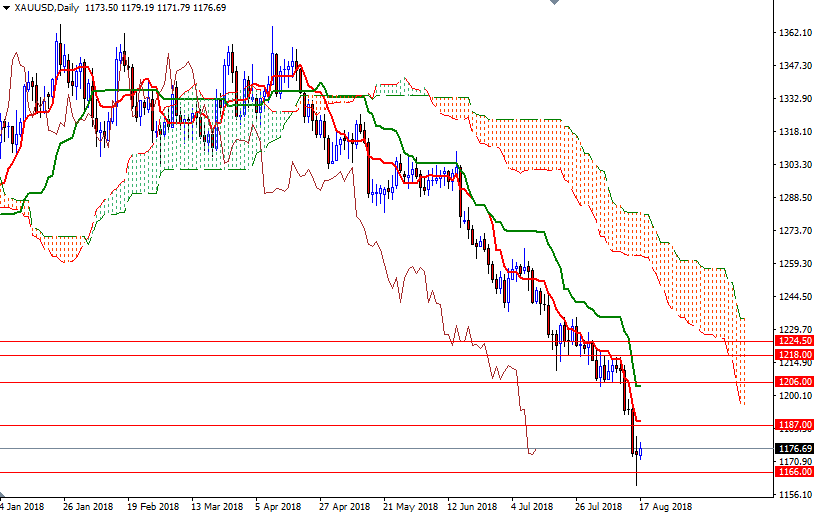

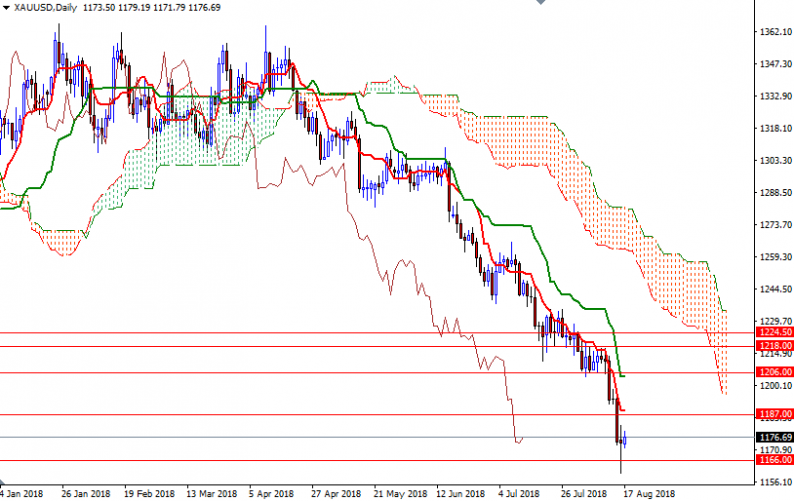

Gold prices edged up in early Asian trade on Friday after hitting a 19-month low in the previous session. The U.S. dollar moved away from 14-month highs on disappointing economic data. The Federal Reserve Bank of Philadelphia reported that the index measuring manufacturing activity in the region fell to 11.9 from 25.7 the prior month. Home construction saw a modest rebound in July, but fell short of market forecasts.

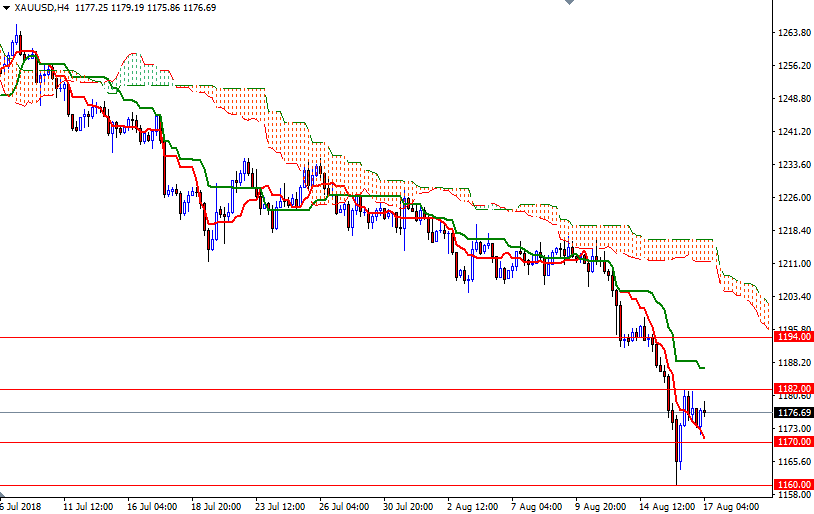

XAU/USD is trading within the borders of the Ichimoku clouds on the H1 and the M30 charts, indicating sideways trading in the near term. To the upside, the initial resistance sits in the 1182-1180.50 zone. If the market convincingly penetrates this barrier, expect a push up towards the 1188/7 area. A break through there brings in 1194.

The bears, on the other hand, will need to capture the bulls’ camp in 1170/69. If this support is broken, it is likely that XAU/USD will revisit 1166/4. Breaking below 1164 implies that the bears are about to retest the strategic support at 1160.

Leave A Comment