Gold prices rose $3.54 an ounce on Wednesday as a sell-off in global equity markets lured investors to the perceived safety of the precious metal. In economic news, the Commerce Department said sales of new homes declined 5.5% to an annualized pace of 553000 homes from 585000. U.S. equity markets closed lower as continued weakness in the technology sector weighed on the main indexes. The European Central Bank will announce its policy decision today with a subsequent press conference from President Mario Draghi.

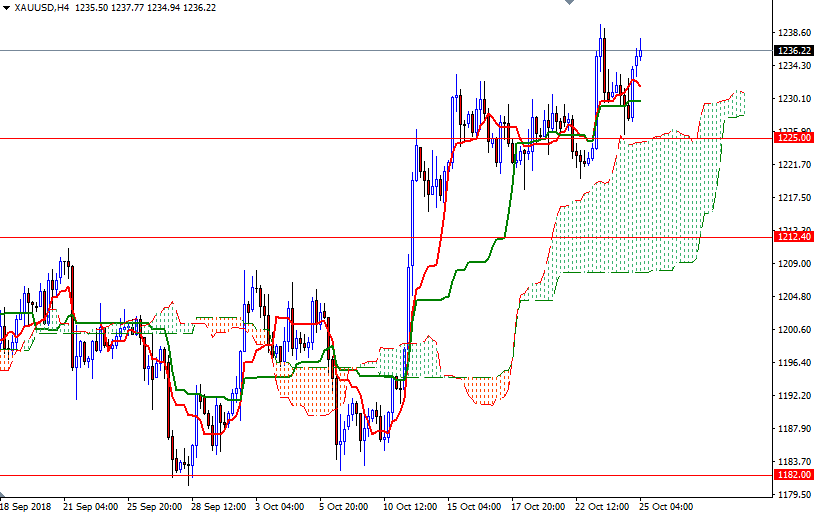

Prices are above the daily and the 4-hourly Ichimoku clouds. In addition, we have positively aligned Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line) on both charts. A sustained break above 1240 could see a move towards the 1252/48 zone. On its way up, expect to see some resistance at 1245.50.

To the downside, the initial support is located at 1235, followed by 1233. The bottom of the hourly cloud sits in the 1230/29 zone so the bears have to push prices below there to revisit 1225/4, the top of the Ichimoku cloud on the H4 chart. If this support gives way, XAU/USD will be targeting the 1220.50-1219.50 area.

Leave A Comment