US elections are here!

Double-click to enlarge this big picture chart for gold.

From both a technical and fundamental perspective, gold looks solid.

This chart suggests that whatever happens in the US election, it’s going to be positive for gold.

One of my biggest predictions for the fall of 2018 was that a US stock market sell-off would see gold and gold stocks begin to function as the ultimate safe haven.

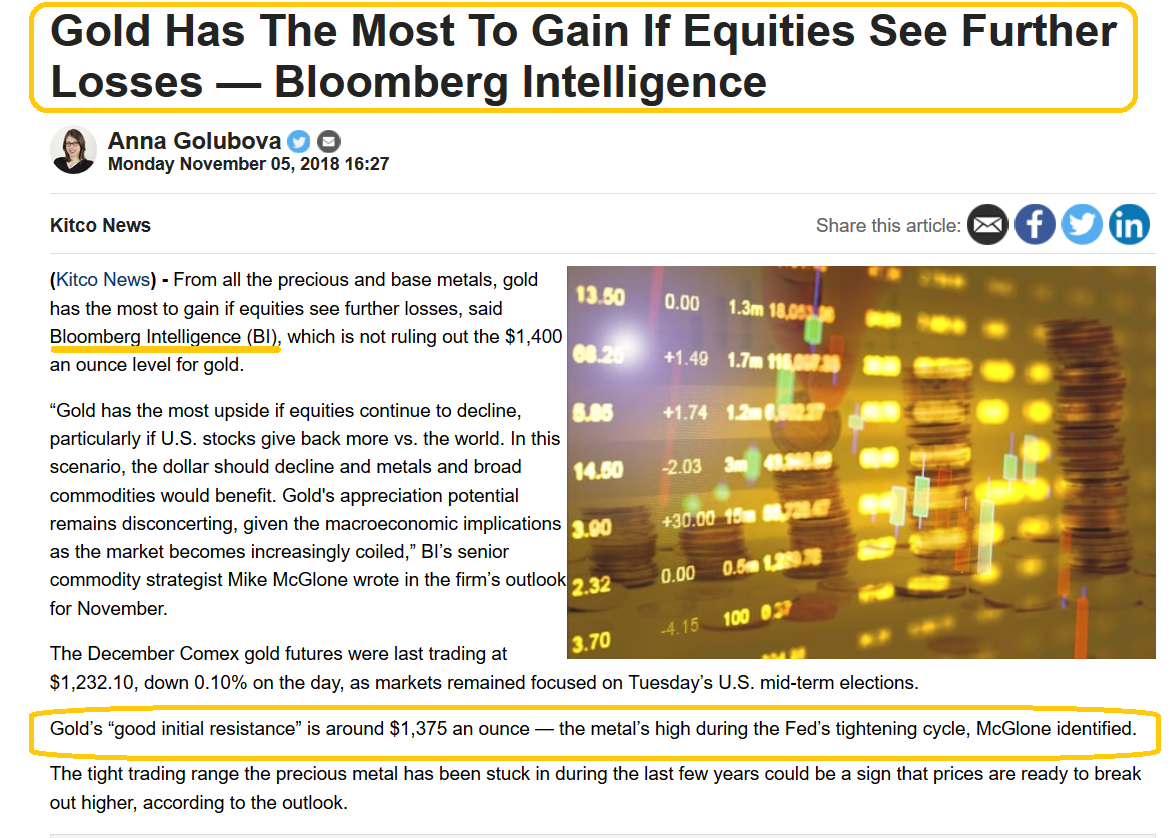

That happened exactly on cue, and to get an idea of how mainstream media is beginning to open their eyes to this theme.

Bloomberg Intelligence is highly respected by the global institutional investor community.

It’s really unknown whether the stock market will rally or decline from here, but the odds are now astronomically high that when the next decline does happen…

The world gold community will be smiling because their precious metal investments will perform admirably!

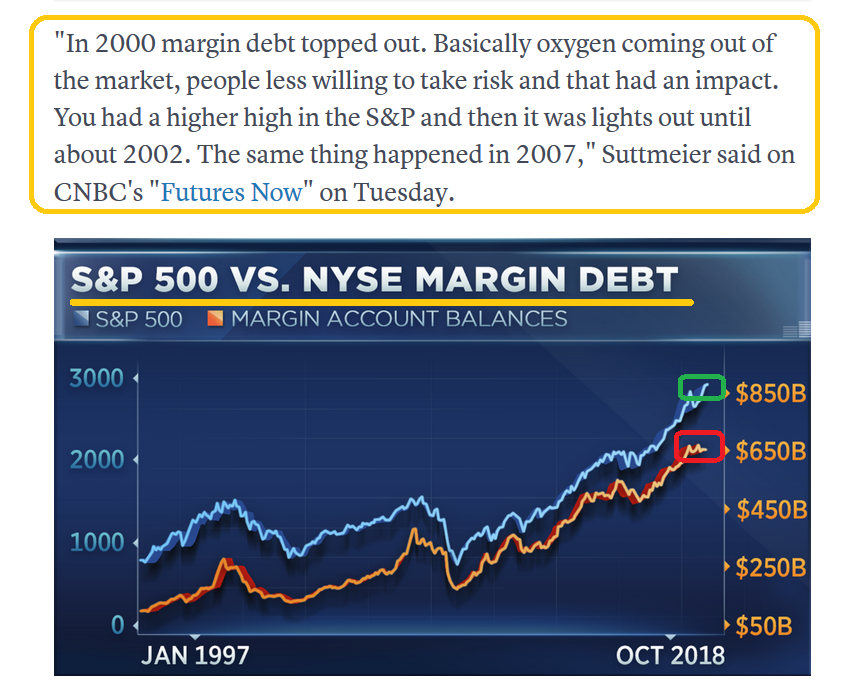

The Fed’s QE and low rate programs incentivized corporations to launch enormous stock buyback programs and incentivized both retail and institutional investors to buy stock with borrowed money.

Merrill’s chief equity market technician is very concerned about the current divergence between the price of the SP500 index and the total US market margin debt.

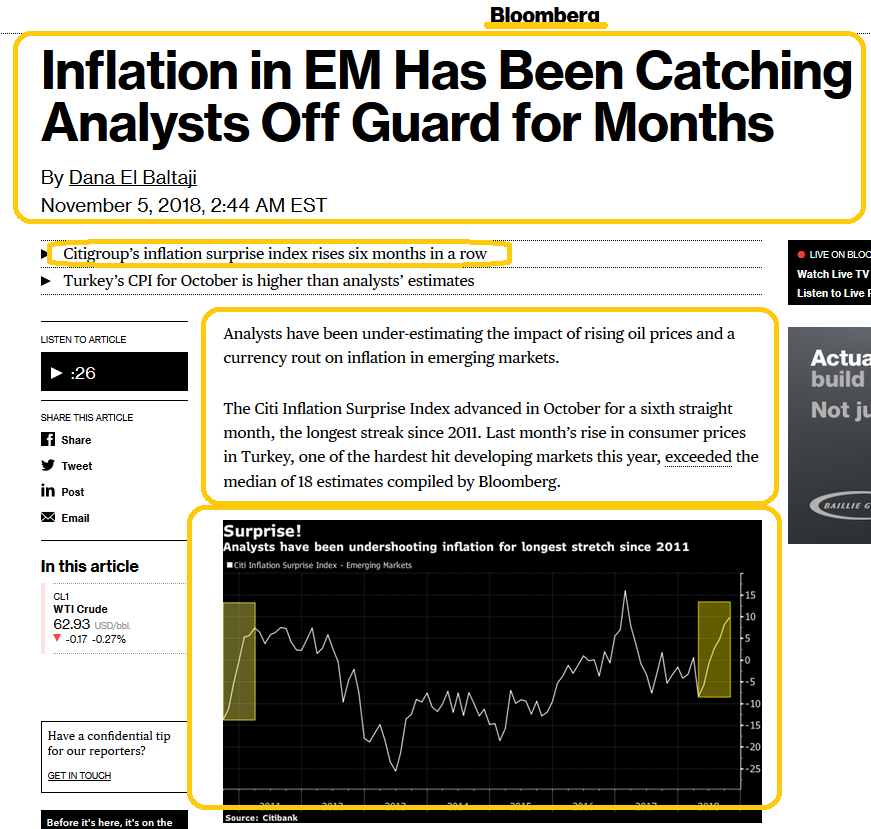

I’ve predicted that as this business cycle ages, inflation would make a surprising appearance that would catch most analysts off guard.

In America, inflation could stage a shocking move to the upside if the emerging divergence between the interest rate on commercial bank excess reserves and the Fed Funds rate grows.

Even if that doesn’t happen, global inflation is clearly on the move, and the move is to the upside!

Western gold bugs may hate the Chinese government for good reasons, but that doesn’t change the fact that it generally acts more like a lean and mean corporation than like a government, in terms of efficiency.

Leave A Comment