Gold has staged a superb rebound from the $1310 support zone, but that was overshadowed by the truly spectacular reversals taking place in most of the Western world’s gold stocks!

I like the technical action being displayed right now. Here’s why:

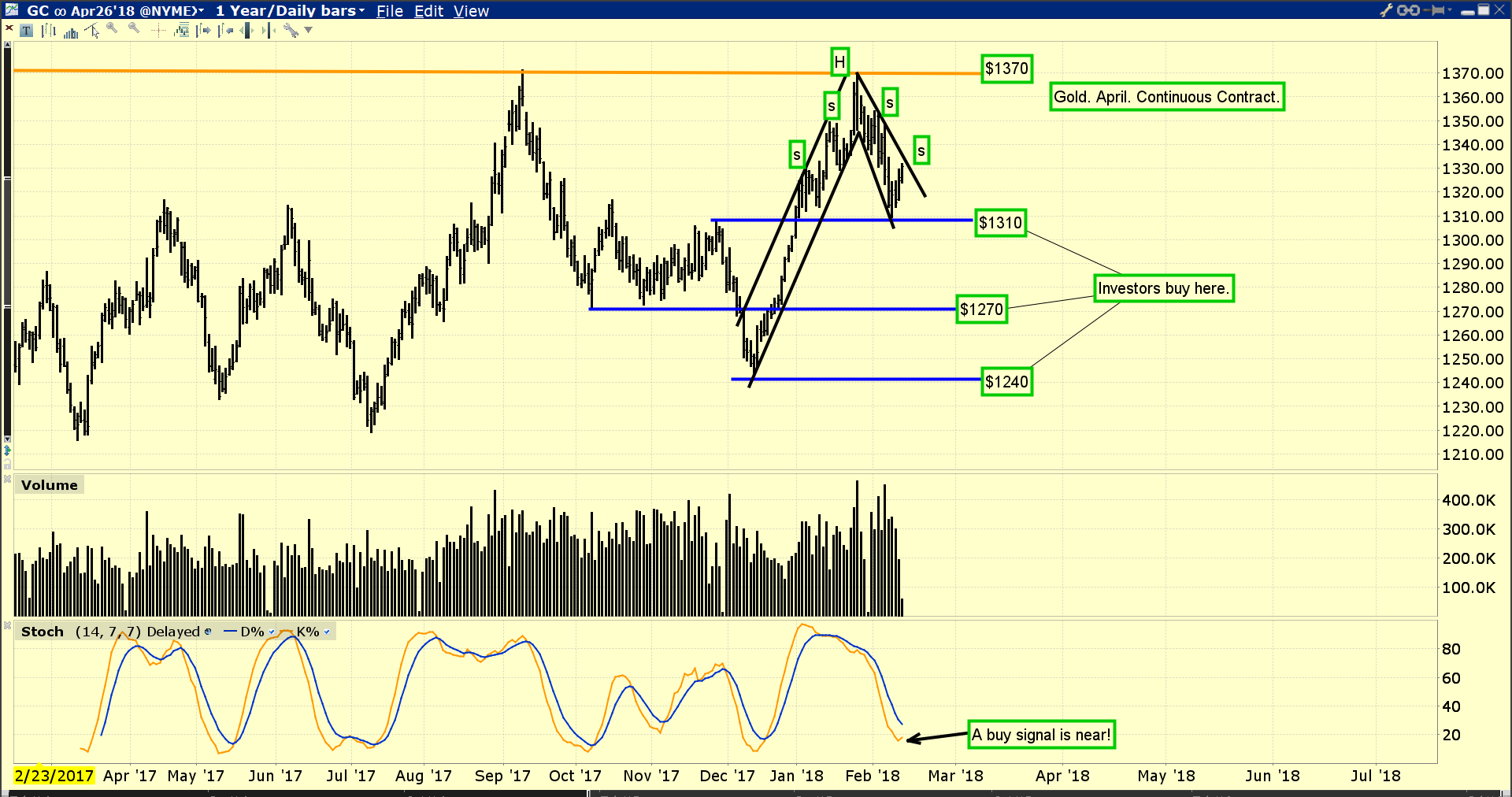

First, $1370 is massive resistance. It’s understandable that gold would build a modest head and shoulders top pattern after arriving at this key price zone.

What’s especially positive is that gold has only modestly declined in the face of this resistance and top pattern. My key 14,7,7 Stochastics oscillator is also modestly oversold now, which is good news.

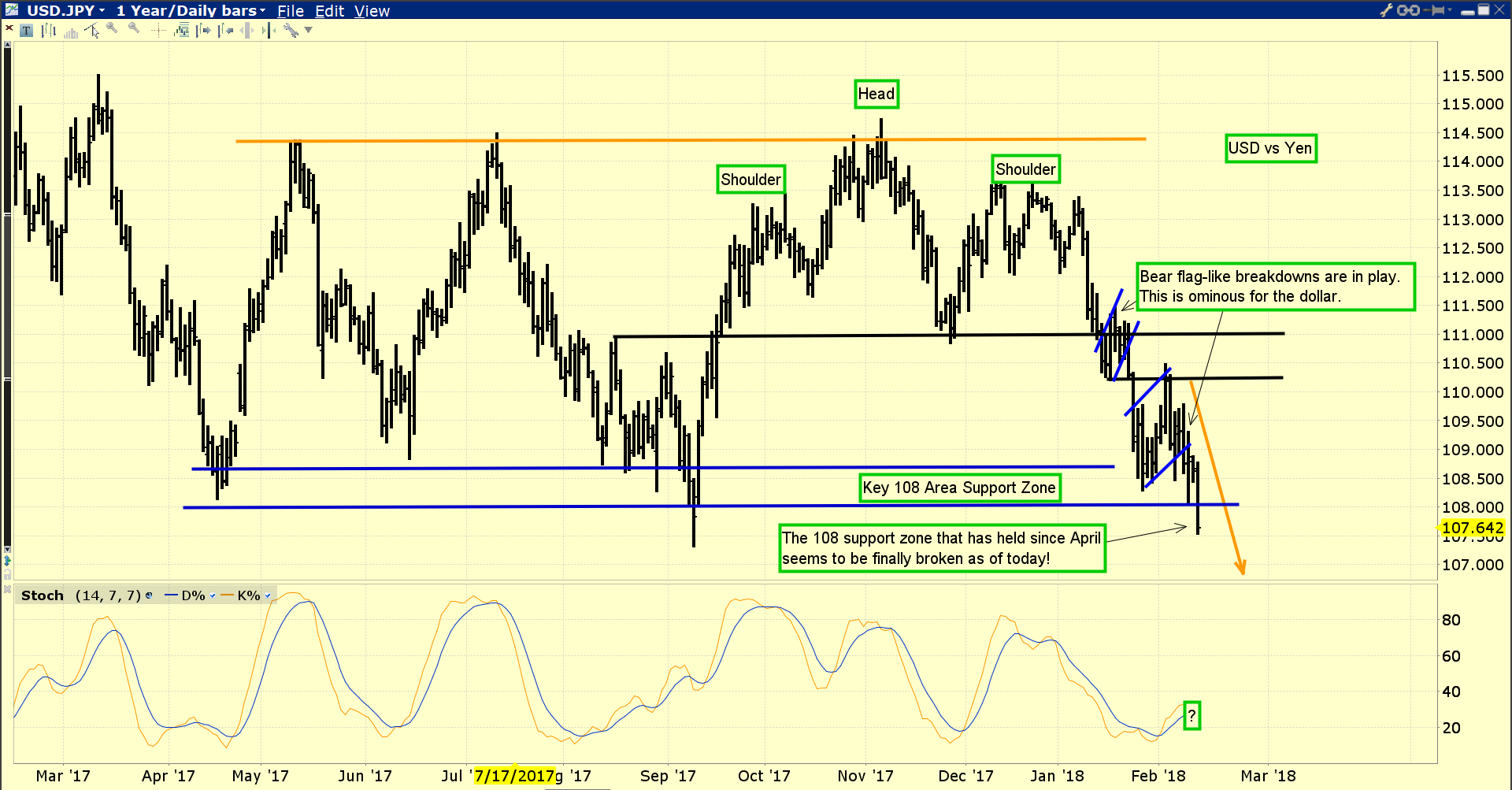

This morning, the dollar broke below key support in the 108 price area against the yen.

When investors bet against central banks, they tend to lose. When they bet against the President of the United States, they can get blown right off the financial map.

The bottom line is that President Trump was elected on a mandate to bash the dollar lower, and it is getting beat on like a rag doll by the yen right now.

The bear flag-like action occurred as the dollar approached this support zone. That is ominous for the dollar bugs, and fabulous news for gold.

Investors don’t need to “back up the truck” when buying precious metal assets right now, but they should be emotionally positive and focused more on gold stocks than bullion.

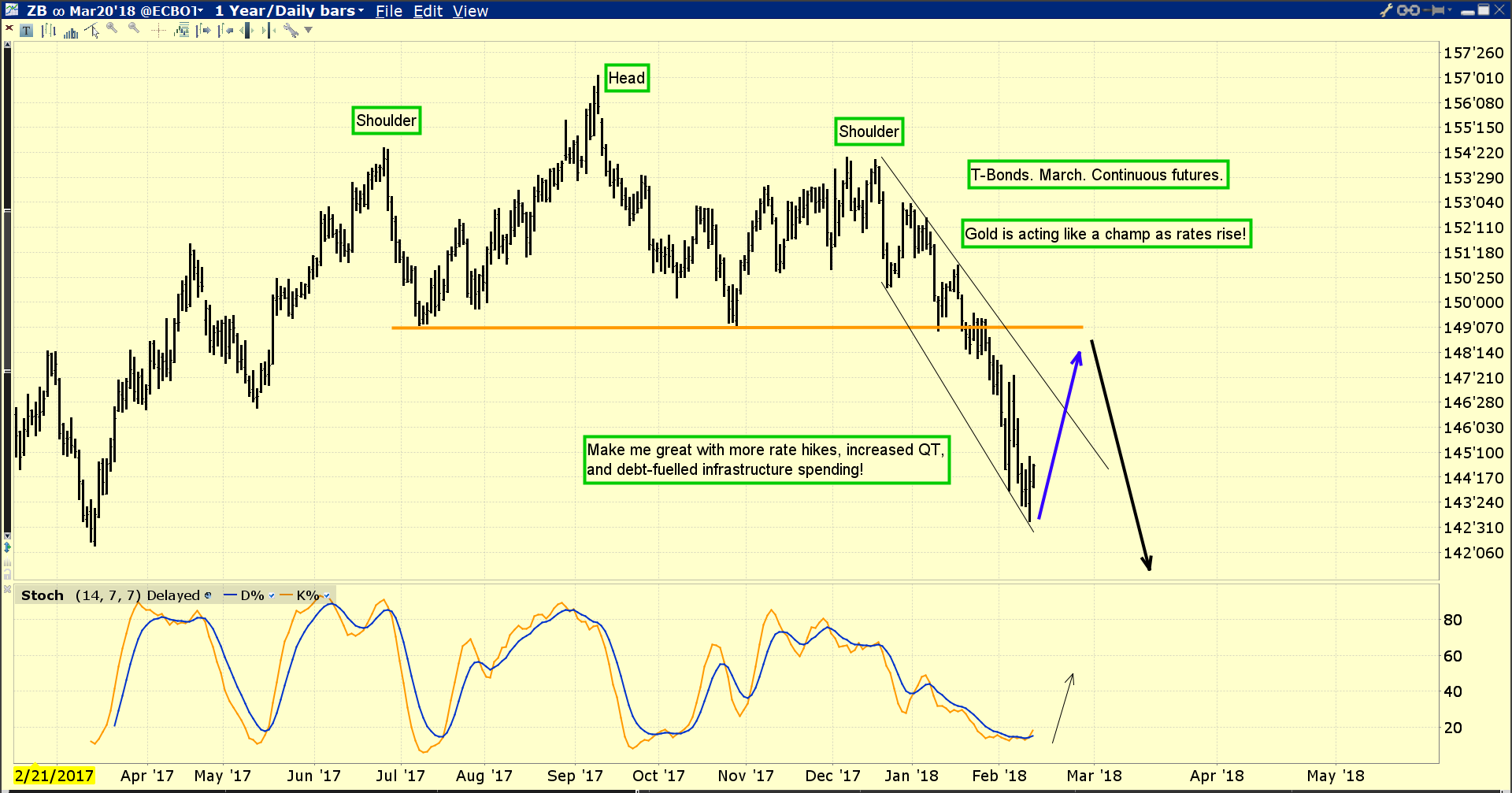

That’s because there is so much news taking place fundamentally in the gold market that favours the miners. Inflation is rising, mainly because quantitative tightening is pushing money out of government bonds and into the banking system.

That’s raising interest rates, incentivizing banks to lend, and putting pressure on the US government’s ability to finance itself.

Since breaking the neckline of a daily chart head and shoulders top pattern, the US T-bond hasn’t even staged a minor rally!

Leave A Comment