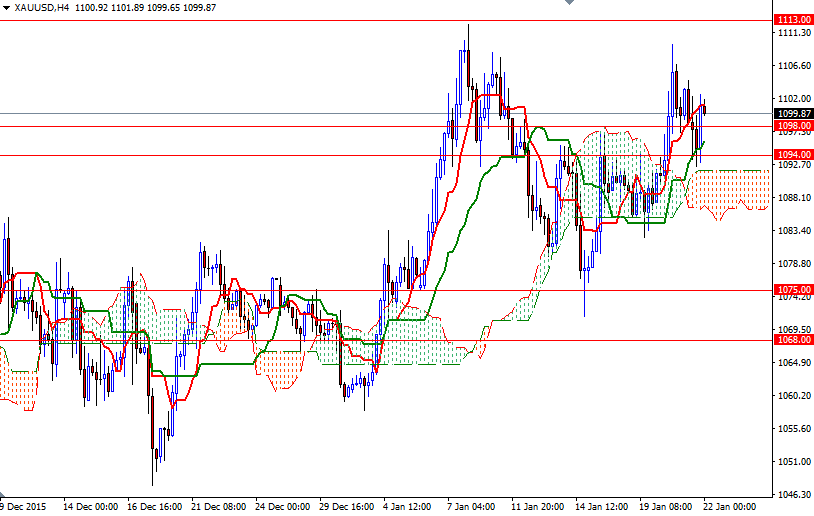

Gold prices ended Thursday nearly unchanged, after a volatile day that saw prices swing between gains and losses. The XAU/USD pair traded as low as $1092.42 an ounce after the European Central Bank signaled that more easing could be coming within months. However buying interest near the 4-hourly Ichimoku cloud helped recover most of the earlier losses.

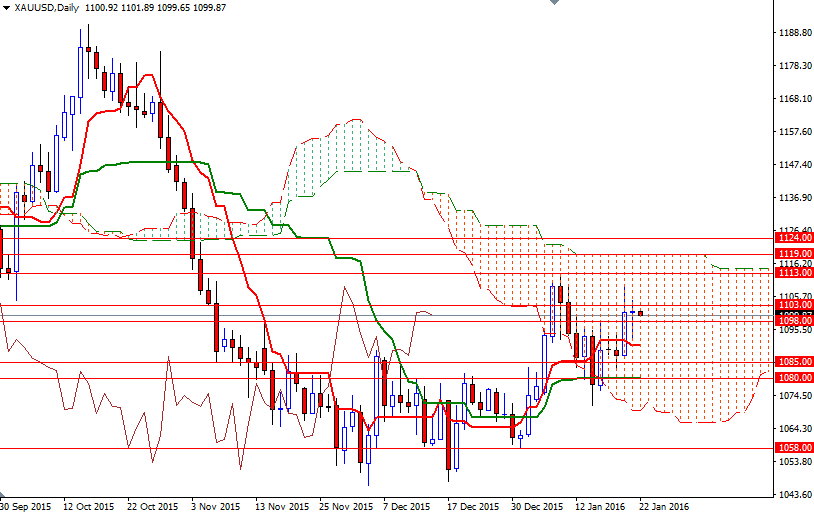

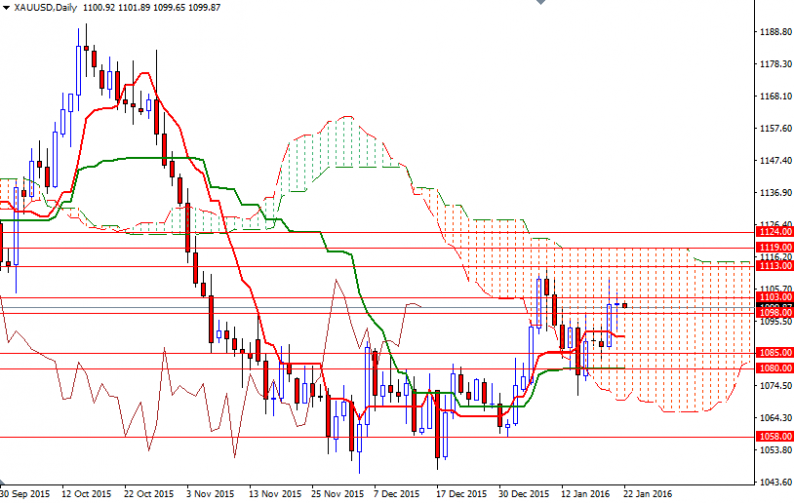

The precious metal is trading at $1099.87, slightly lower than the opening price of $1100.92. From a purely technical point of view, the odds favor further upside as long as the XAU/USD pair remains above the Ichimoku cloud on the 4-hour time frame. The long lower shadow of yesterday’s candle and positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines also improve the short-term picture.

The market is stuck in a tight trading range during today’s Asian session so I will keep an eye on the 1098/7 and 1105.50-1103 zones. If the XAU/USD pair climbs and holds above 1105.50, I think the bulls will have a chance to tackle the resistance at 1113. In order to gain enough momentum and reach the 1119 level, the bulls have to break through 1113. On the other hand, if the resistance above remains intact and the market breaks below 1098/7, it is likely that we will see XAU/USD testing the next supports at 1094 and 1091.88-1090.47. Once below 1090.47, the market will be aiming for the 1086.41-1085 region where the bottom of the cloud sits on the 4-hour chart.

Leave A Comment