It’s been a while since I have written about precious metals. To some extent, this has been on purpose. I am a long-term fan of our little yellow friend, but there are definitely periods when I am more bullish than others. Over the past half year, my enthusiasm for precious metals has been tempered by one important chart…

During this period, the yield on the US 5-year TIPS (Treasury Inflation Protected Security) has been steadily rising. It’s not a perfect comparison, but you can think about this as the risk free real yield – the yield you will earn after inflation.

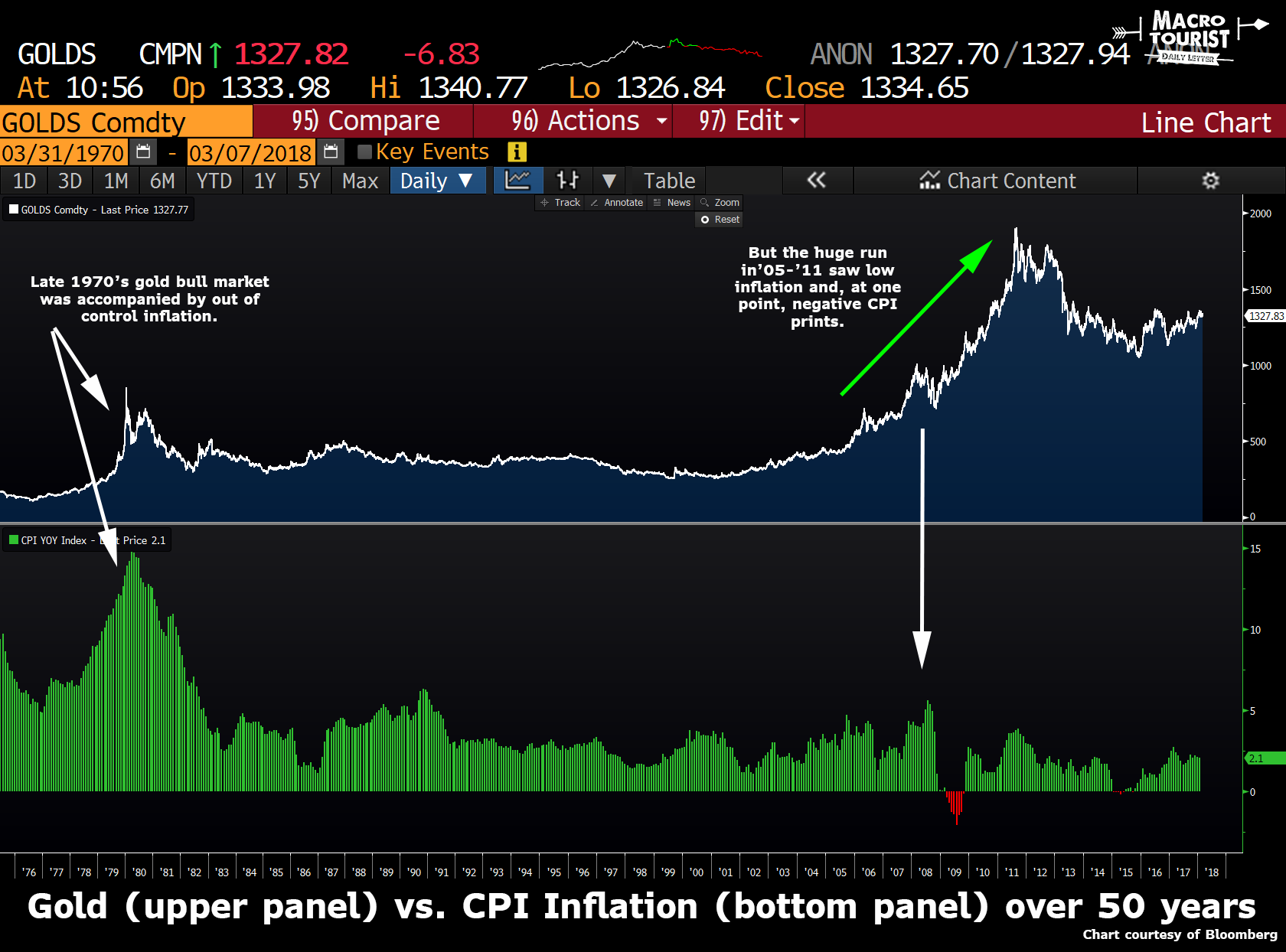

Many market pundits mistakenly believe inflation is the most important determinant of gold’s price level. That’s simply not the case. Although the great bull market of the late 1970’s was accompanied by high inflation, the 2005-2011 rise was in the midst of tame inflation, with CPI even ticking below zero for a period.

No, inflation is just one part of the puzzle for gold. The other important piece is the nominal interest rate. In the 1970’s, inflation was running at 10% or even higher. But for a while, interest rates were lower than the inflation rate. The real yield was therefore negative. In this environment, gold provided an attractive alternative to holding cash and other fixed income instruments that were suffering from financial repression. After all, gold is also a currency, with no yield. Yet the real benefit is that it is no one’s liability. With positive real yields it is difficult to justify owning gold, but push those yields into negative territory, and suddenly gold becomes more appealing.

And that’s exactly what happened in the 2000s. Inflation was low, but interest rates were even lower, creating one of the greatest precious metals bull markets of all time.

Recent Fed policy

But lately, with the Federal Reserve attempting to normalize monetary policy with higher short-term rates, I have been hesitant to be gung-ho bullish on gold.

Leave A Comment