Gold prices declined for the third time in four days as better than expected U.S. economic data and gains in equities curbed appetite for the metal. Data from the Labor Department showed that the producer price index rose 0.5% and only 254K people filed new claims for unemployment benefits when a jump of 11K was expected. The XAU/USD pair tested the 1320 level as expected after the 1332/0 support gave way.

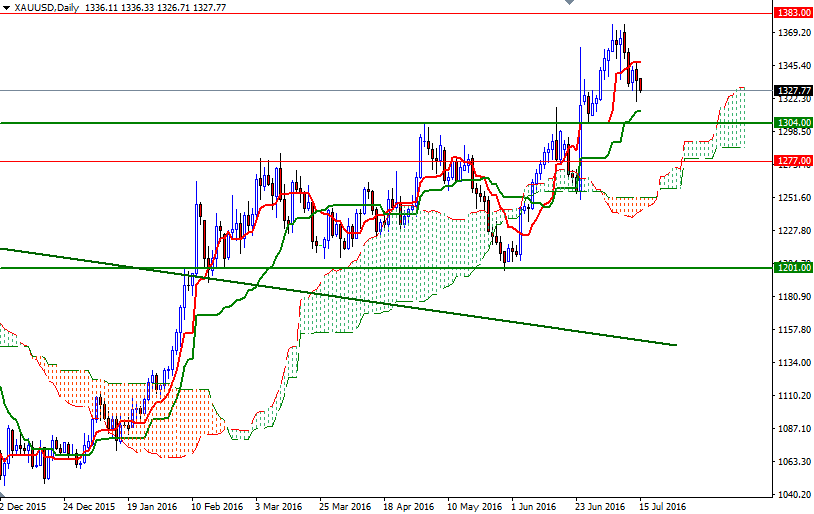

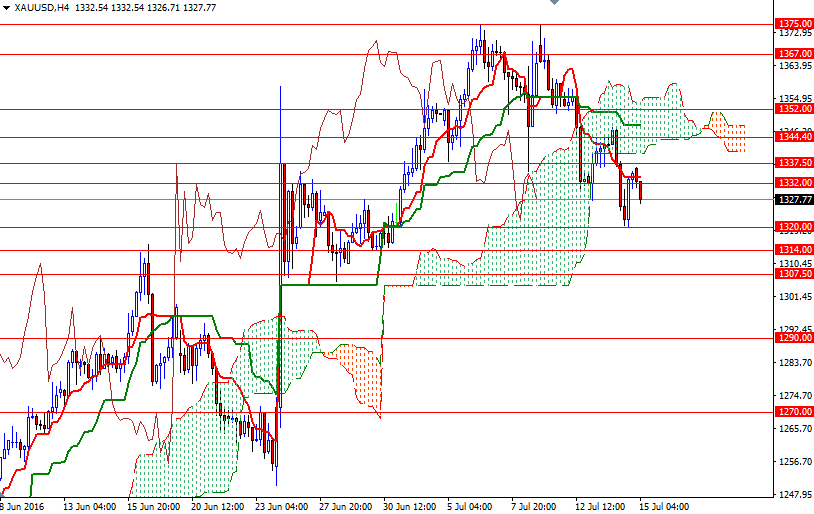

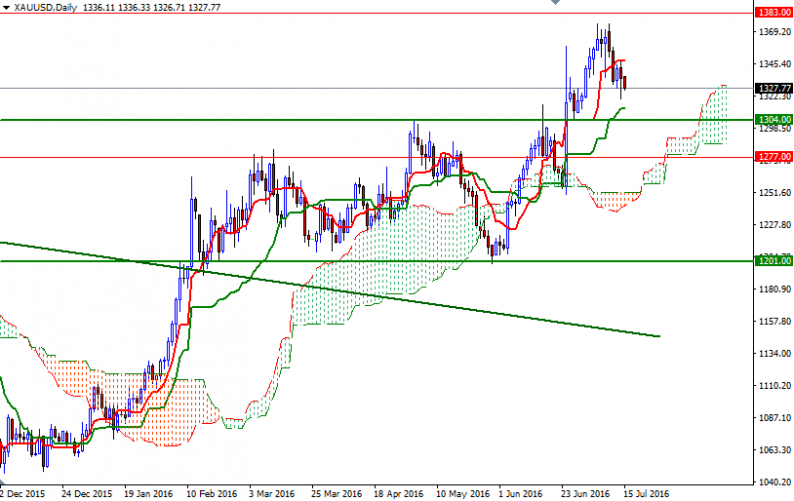

The XAU/USD is currently trading at 1327.77, slightly lower than the opening price of 1336.33. Since last Friday, I have been repeating that the short-term outlook was weak and the market was in overbought condition. Residing below the Ichimoku cloud on the 4-hour chart suggests that the market will continue to feel selling pressure. In other words, we might revisit the 1325 and 1320 levels later today. However, keep in mind that the medium-term technical picture is still bullish. If prices fall through 1320, then look for further downside with 1314 as target. Breaking down below the 1314 level could encourage sellers and increase the possibility of an attempt to test the 1307.50-1304 area.

To the upside, there are hurdles such as 1332/0 and 1337.50. The bulls have to push prices beyond 1337.50 if they intend to make an assault on the 1344.40-1342 zone where the bottom of the 4-hourly cloud sits. Once beyond that, the market will be aiming for 1347.63 -which happens to be the daily Tenkan-Sen (nine-period moving average, red line)- and 1355.20-1352. Closing above the 1355.20 level could provide the bulls the extra fuel they need to approach 1367.

Leave A Comment