Gold edged higher on Tuesday as investors awaited Federal Reserve minutes of its June meeting. Also an intercontinental ballistic missile test by North Korea triggered some safe-haven buying that helped underpin gold. XAU/USD is currently trading at $1227.76 an ounce, higher than the opening price of $1223.54, but still not too far from seven-week lows hit on Monday.

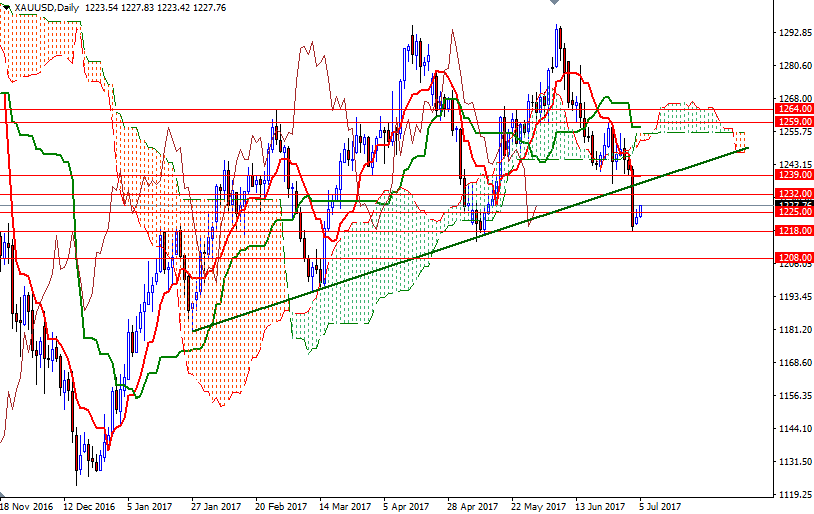

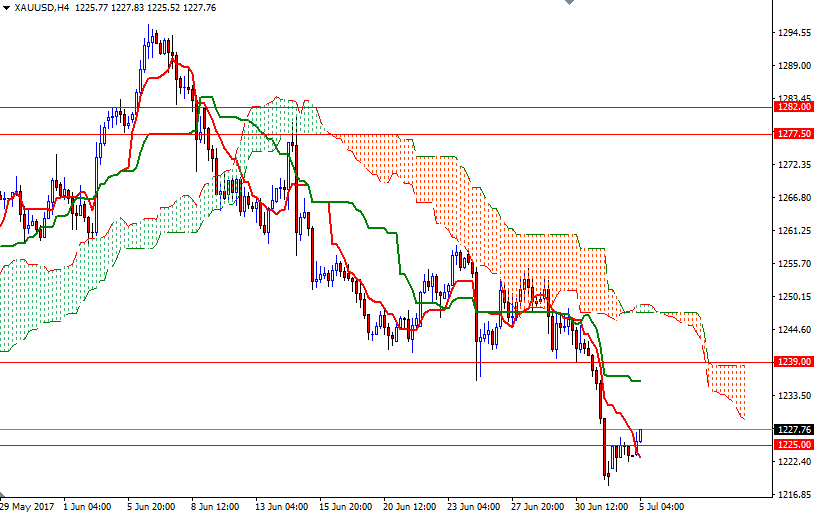

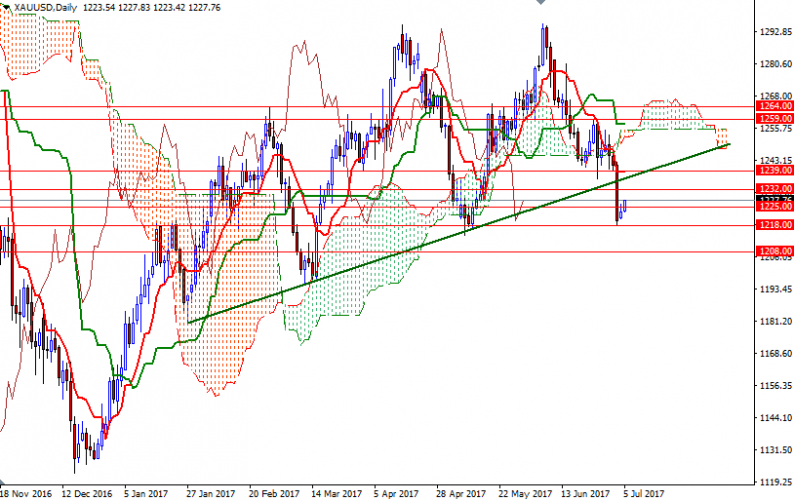

The short-term picture continues to be bearish, with the market residing below the Ichimoku clouds on both the daily and the 4-hourly charts. Negatively aligned Tenkan-Sen (nine-period moving average, red line) – Kijun-Sen (twenty six-period moving average, green line) lines are also adding to the negative outlook. However, beware that prices are inside the weekly cloud as it suggests a range-bound movement.

The bottom of the hourly cloud sits near the 1228 level, so the bulls will need to break through there to gather momentum for 1233/2. If the bulls manage lift prices beyond 1233, then it is likely that the market will test the 1239/6 zone, where the Kijun-Sen on the H4 chart and the broken trend line converge. Although there are possibly supportive levels right below (1225 and 1222), I don’t see anything good until 1218/5. A sustained break above 1215 implies that 1208/5 zone will be the next target.

Leave A Comment