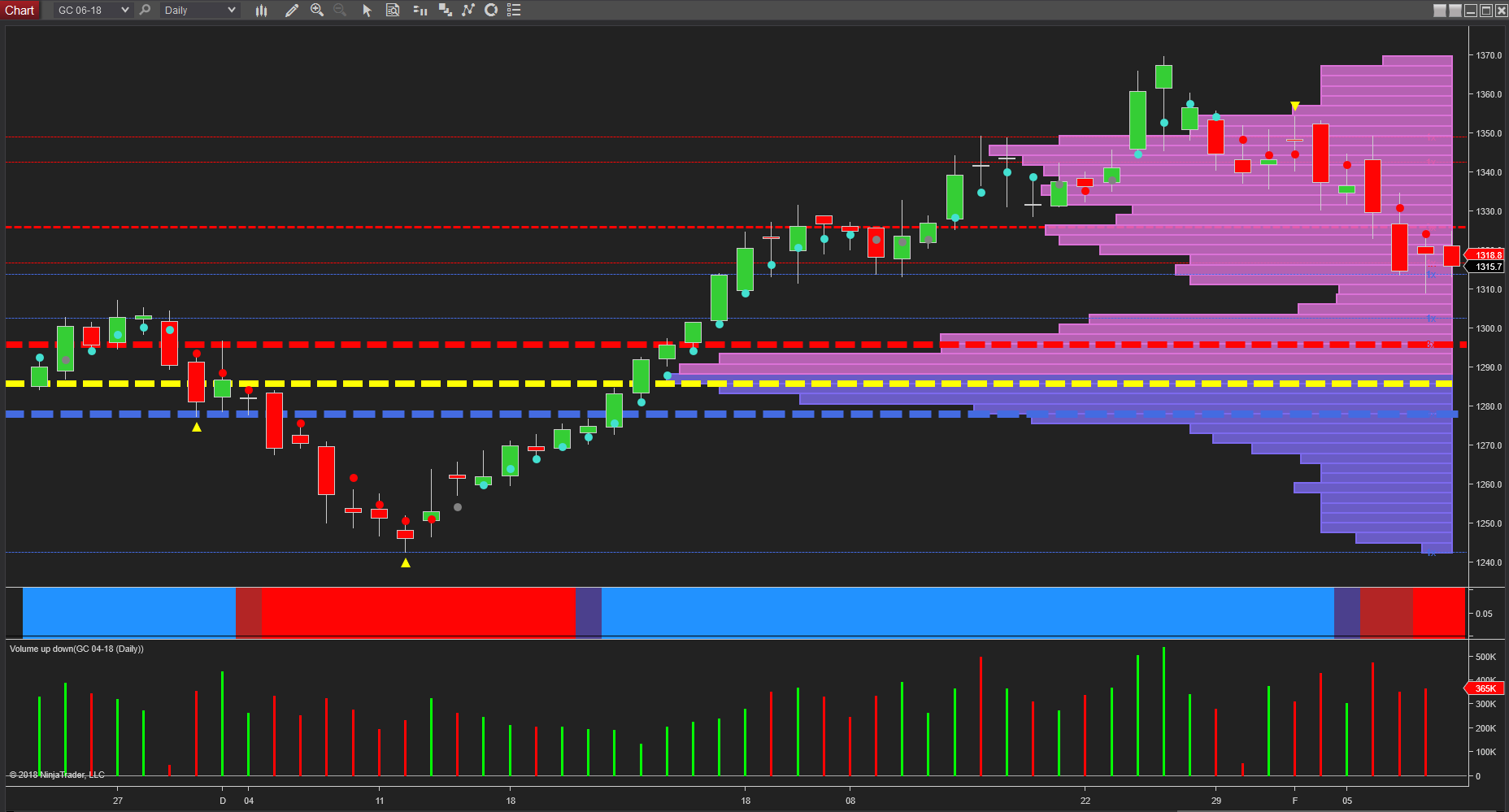

For gold bugs, the start of 2018 heralded some much needed good news, with the precious metal climbing steadily and building on December’s bullish sentiment as gold prices climbed steadily off the lows of $1240 per ounce to touch a high of $1369.70 per ounce for the June futures contract on the daily chart. Sadly, that was the end of the good news as gold gapped down the following day, with bearish momentum then accelerating as February got underway.

With the trend monitor indicator now transitioning from bullish to bearish this past week as gold closed on Friday at $1315.70 per ounce the question now, of course, is where next? And perhaps most interestingly, given the cataclysmic price action for risk on assets and immensely strong flows into safe haven assets such as the yen, none of this has been reflected in the price of gold, which not only failed to rise, but fell in line with falling stock markets globally. And while strength in the US dollar would have had some effect, the extreme moves in the VIX should have triggered strong flows into gold, which is clearly not the case, and certainly not a good signal for the precious metal gold over the longer term.

Moreover, given that one of the reasons suggested for the current sharp correction in equities has been the move higher in bond yields as a result of concerns about inflation, even this traditional reason for holding gold has failed to move the precious metal higher.

From a technical perspective the volume point of control on the daily chart now sits below in the $1285 per ounce region as denoted with the yellow dotted line, and with a low volume node now awaiting below in the $1310 per ounce area, any move to this level is likely to see the price of gold move swiftly through this region and down towards a developed area of support in the $1295 per ounce region and denoted with the red dotted line and where a potential platform of support awaits.

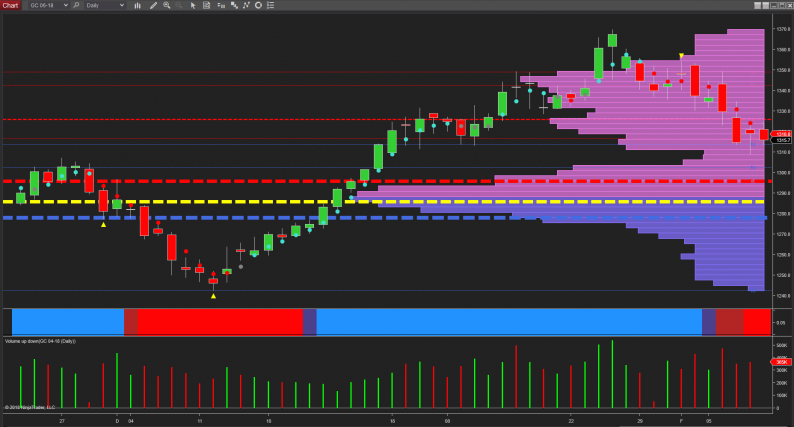

Moving to the weekly chart, this helps to provide clarify and confirm the current change in trend, and as we can see, this chart offers several clear signals. First, note the ultra high volume of the last week in January with the candle closing with a deep wick to the upper body as it tested the strong resistance level overhead, as shown with the blue dotted line of the accumulation and distribution indicator. Indeed, this level was also tested in September 2017 which also held with gold prices rolling over into a bearish trend. The first week in February 2018 has then confirmed the current bearish sentiment creating the two bar reversal as a result, with gold prices falling last week on the wide spread down candle, and now looking set for a repeat performance of the last quarter of 2017.

Leave A Comment