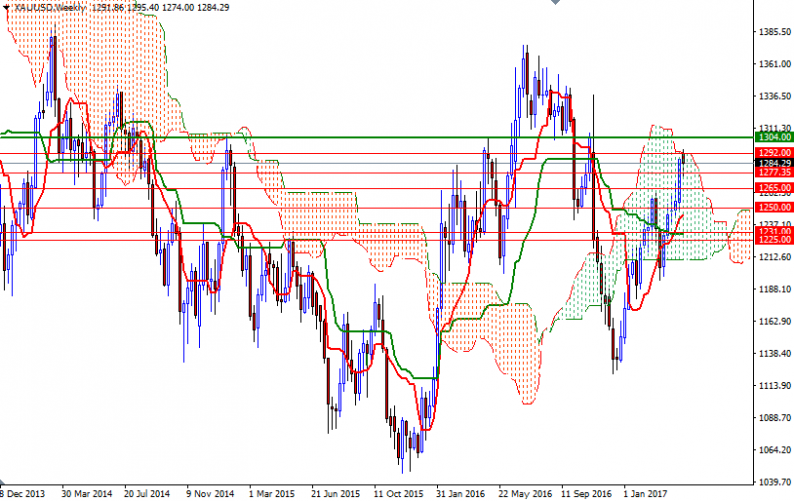

Gold ended the week down by 0.58% at $1284.29, suffering the first weekly loss in six, as investors cashed in recent gains driven by a range of geopolitical tensions. After hitting a fresh five-month highs on Monday, XAU/USD retreated to the $1277.35-1276 support area before recovering to the current level. The major event on everyone’s radar is the first round of French presidential election. It is unlikely one of anti-EU candidates, such as right-wing National Front Leader Marine Le Pen, will end up becoming the next president, but if the unexpected happens, it could push prices higher.

On the other hand, if the geopolitical tensions ease in the coming days and equity markets gain, these may choke off the oxygen that gold needs to keep going higher. From a chart perspective, there are two things that catch my attention at first glance. Firstly, XAU/USD is still stuck in the weekly Ichimoku cloud, though the market is trading above the Ichimoku cloud on both the daily and 4-hourly charts. It seems that gold lost some momentum but selling was relatively muted, suggesting that the period of consolidation may last a bit longer.

Despite the fact that the bulls have the medium-term technical advantage, the near-term picture will likely depend on the direction prices will exit. It is quite possible that XAU/USD will gain momentum if the market can push through the 1295/2 zone, where the top of the Ichimoku cloud on the weekly chart sits. In that case, I think the bulls will an opportunity to challenge the bears waiting in the 1308/4 region. Closing above 1308 implies that 1315 and 1325 will be the next targets. Breaking down below 1276, on the other hand, means the market will tend to visit 1272 and 1269. The bears have to drag prices below 1269 if they intend to tackle the solid support in the 1265/1 area.

Leave A Comment