– Gold will be safe haven again in looming EU crisis

– EU crisis is no longer just about debt but about political discontent

– EU officials refuse to acknowledge changing face of politics across the union

– Catalonia shows measures governments will use to maintain control

– EU currently holds control over banks accounts and ability to use cash

– Protect your savings with gold in the face of increased financial threat from EU

When we talk about the Eurozone crisis we are usually referring to the Eurozone debt crisis. According to the OECD the debt crisis of 2011 was the world’s greatest threat.

In the years that followed, Germany, France, and the UK led EU members in their efforts to stave off debt defaults from the likes of Ireland, Portugal, Italy, Spain and, of course, Greece. This was partly in order to protect the German, French and UK banks who had lent irresponsibly into the periphery EU nations and were very exposed.

In recent months one could argue that things were starting to look up for the single-currency area. Recent headlines report that the Eurozone’s recovery is firmly underway. Manufacturing workloads are rising and companies are hiring at their fastest pace in over a decade.

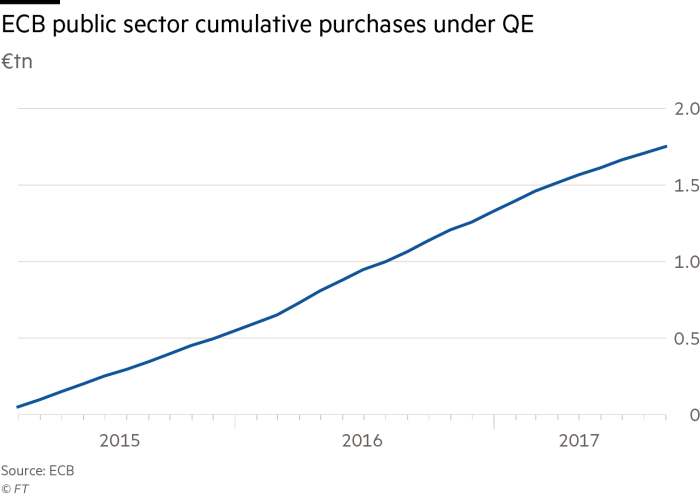

Of course, much of the recovery is attributed to the ECB and their bond purchasing ‘stimulus’ of €60 billion euros every single month … courtesy of Super Mario’s Bazooka. This is unlikely to come to a halt later today in what is being touted as the central bank’s most important policy meeting recently.

There are a few different potential outcomes to the meeting, but none will address the new and very real and very pressing Eurozone crisis: the growing political crisis.

Political change: the real Eurozone crisis

Ever since the debt crisis exposed the cracks in the ‘single currency’ union, the increasingly two-tier economy has caused more and more problems, both economic and political.

Germany has surged ahead in terms of productivity and GDP growth. Meanwhile, the southern states have experienced economic pain.

Throw into the mix various EU requirements on countries such as free movement of labor and refugee quotas and it isn’t just the poorer countries that are feeling the heavyweight of eurozone politicians.

This has inevitably given way to a populist surge in politics as voters become increasingly disenfranchised with the EU first, country second approach of their own elected governments and the unelected bureaucrats in Brussels.

Leave A Comment