Can a gold investor have their cake and eat it too? Is it possible for the Western fear trade and the Eastern love trade to push the price of gold higher at the same time?

I believe the awesome answer to that question is a definite, “Yes!”, and here’s why I say that: America has a president who has launched dollar-positive tariffs. It now appears that these tariffs are “here to stay”. This president has also talked about giving T-bond holders a “haircut”.

The easiest way to keep tariffs, promote exports, and give bond holders a haircut without a default is to devalue the dollar.

I think dollar devaluation lies ahead, and given the advanced state of this enormous inverse head and shoulders bull continuation pattern, it may happen a lot sooner than most investors think.

It can be persuasively argued that the biggest weight on gold demand since 2011-2012 has been India’s gold import duty and gold-negative government policy.

The 80-20 import rule is gone, demonetization is in the past, the GST fiasco is over, and a panel has been set-up with a mission to double the gold sector’s contribution to GDP over the next five years! The only gold-negative policy promoted by India’s government now is the import duty.

While the dollar’s surge against the rupee and high oil prices make a duty cut unlikely in the short term, some form of dollar devaluation from the US Treasury would change the outlook for a cut dramatically.

Even without a duty cut, everything else happening for gold there is becoming positive. Demand is growing and that growth appears to be “here to stay”.

When tariffs first knocked the Chinese stock market lower, it weakened the celebratory mood of Chinese gold buyers.

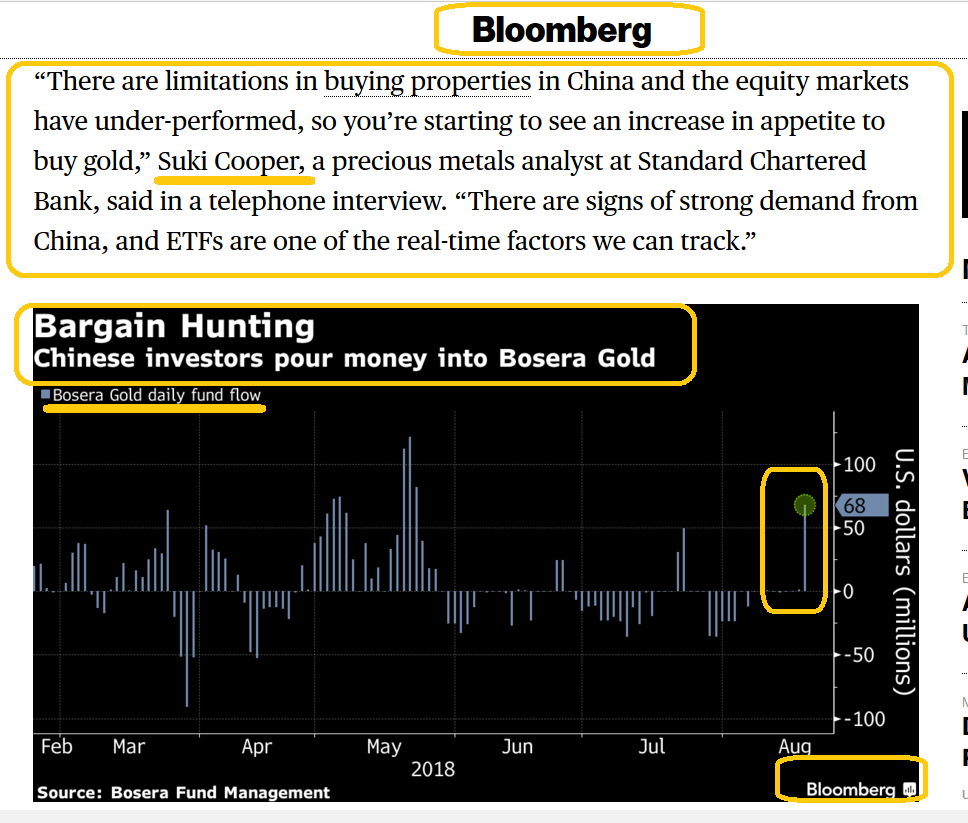

As the stock market weakness persists though, Chinese investors are beginning to allocate new money to gold.

Leave A Comment