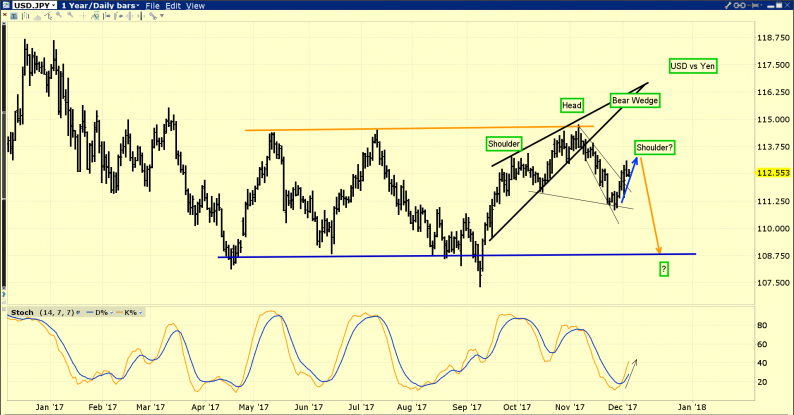

For the past few weeks I’ve suggested that a modest US dollar rally against the yen (and thus gold) was due, and now it’s here.

The dollar’s right shoulder rally fits with the US senate’s decision to finally pass some corporate tax cuts. That’s modestly good news for “risk-on” investors.

It’s modest because it comes at a late stage in the business cycle. Many institutional money managers are trimming US stock market holdings. They are investing the proceeds into key Asian markets where corporate profits are rising but P/E ratios are lower.

This is typical market action in the late stages of the US business cycle; the Dow stocks keep rallying, and the growth stocks stumble.

I’m pretty comfortable with my Chinese stock market holdings. If there is a crash, I’ll simply buy more and urge savvy investors to do so too.

In the big picture, American citizens are outnumbered by Asians. There are about eight Chindians for every American.

Cars are turning into moving offices. Business owners will be happy to sit in rush hour in their electric self-driving cars, because they will be able to work.

Many workers will get paid the moment they leave their house and start their car engines. They will work in self-driving company cars on the way to their workplace.

Car accidents should decline by 95% or more.

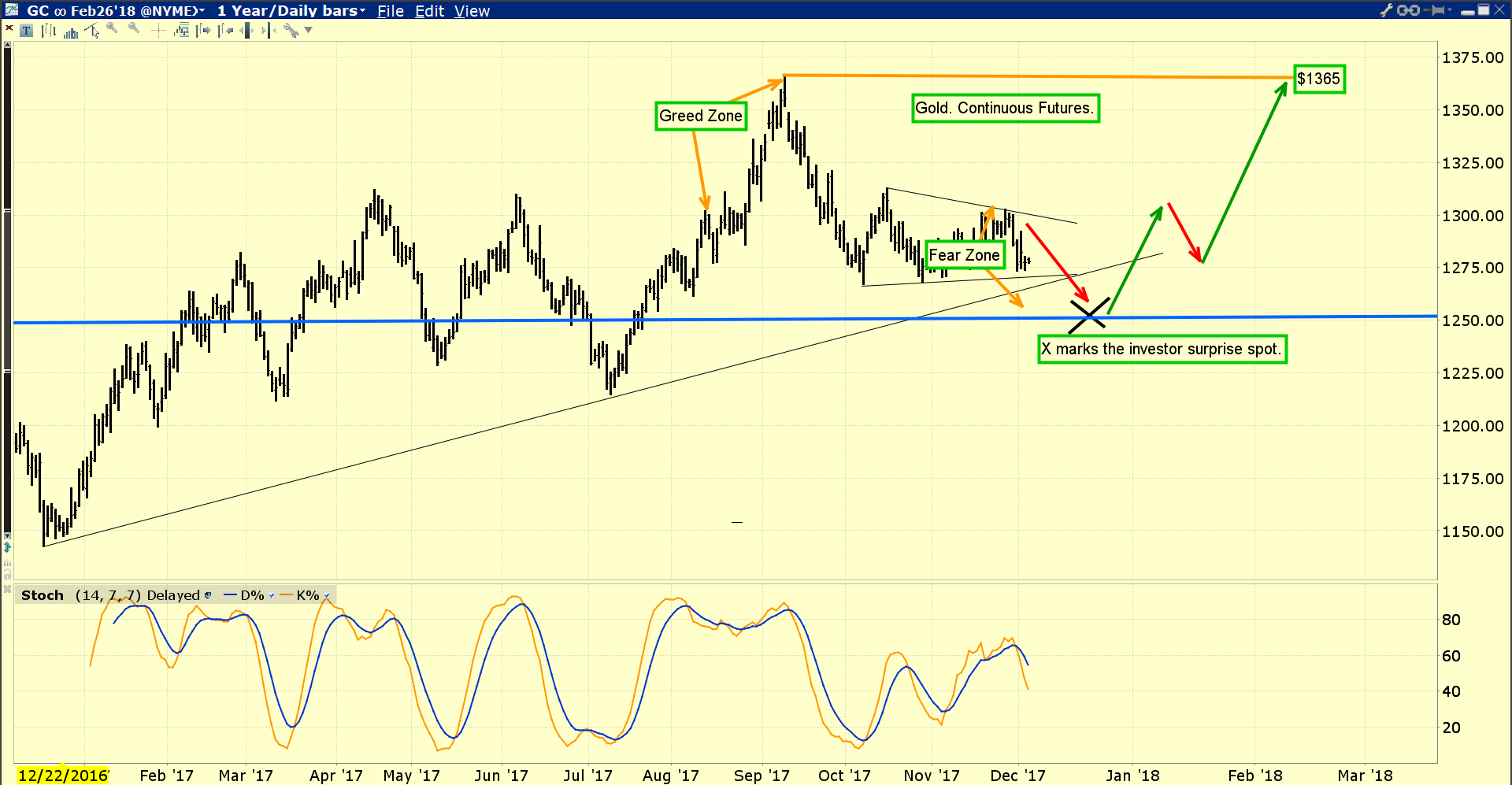

Gold is in “mellow” mode here, but some (Western) investors are disheartened.

New surveys show that institutional money managers now expect three rate hikes in 2018, yet gold barely swoons on the news. In India and China, investors buy gold in both good times and bad. Rate hikes are viewed as almost irrelevant to gold price discovery.

Price discovery continues to move from the West to the East, and that means rate hikes will soon become even more irrelevant to gold than they are now.

Leave A Comment