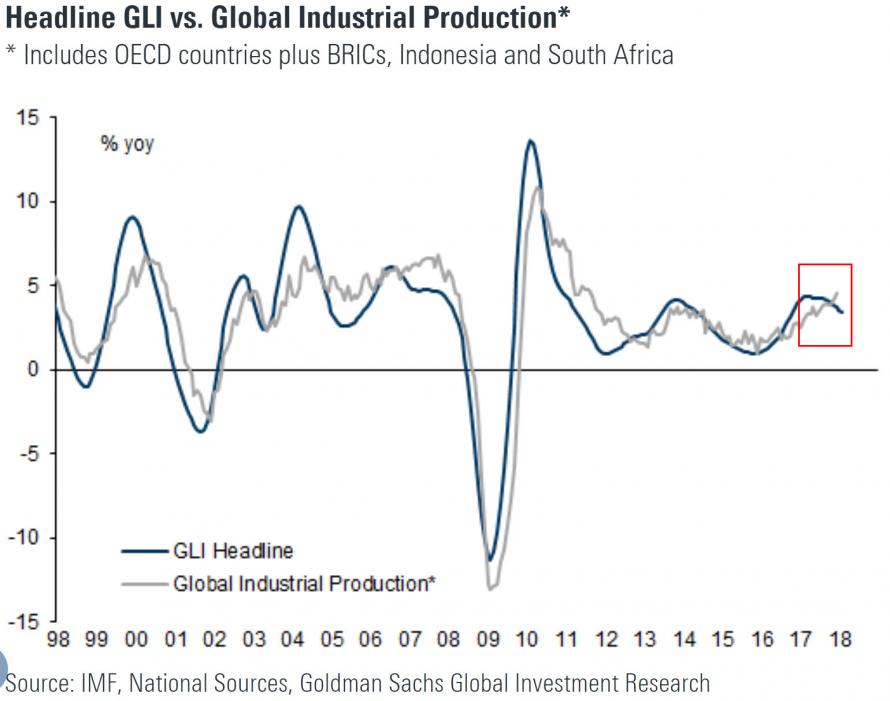

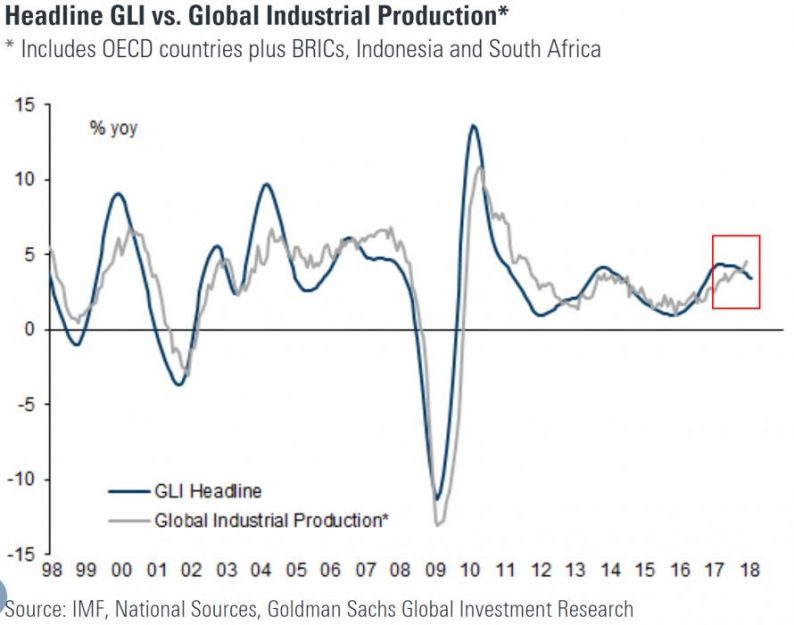

Seven of the ten underlying components of the Goldman Sachs’ Global Leading Indicator (GLI) weakened in February slightly to 3.46% in February, down from our January estimate of 3.56%.

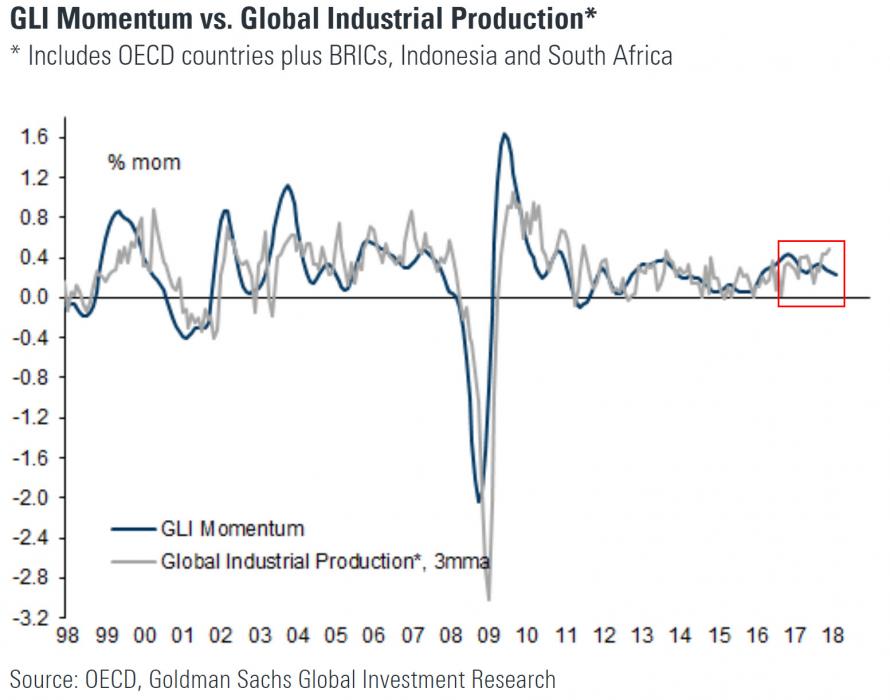

GLI momentum (MoM growth) decreased to 0.234% from 0.249% last month, the lowest level for GLI momentum since March 2016.

The Global Leading Indicator (GLI) is a Goldman Sachs proprietary indicator that is meant to provide an early signal of the global industrial cycle on a monthly basis.

The only component that showed a meaningful improvement was US initial claims, which fell to a 49-year low today.

The largest declines came in the Japan IP inventory/sales ratio and the aggregate of the Australian and Canadian Dollar trade-weighted indices, both of which softened by roughly one standard deviation.

The global new orders less inventories component and Korean exports also worsened, with relatively minor moves in rest of the components.

Goldman’s GLI disappointment also confirms the recent collapse in G10 economic data relative to expectations…

Bottom Line – it’s tough to keep arguing for a global synchronous recovery when the world’s biggest economies are all rolling over together.

And don’t forget what’s driving the rollover…

Leave A Comment