Ok, so as you know, Goldman is considering getting into the Bitcoin trading business.

Last month, WSJ reported that the bank is “weighing a new trading operation dedicated to bitcoin and other digital currencies, [making it] the first blue-chip Wall Street firm preparing to deal directly in this burgeoning yet controversial market.”

Yes, “burgeoning yet controversial.” That news of course came on the heels of Jamie Dimon’s well documented criticism and also amid all kinds of other cat calls not the least of which emanated from “Gandalf” himself, JPM’s Marko Kolanovic, who suggested that cryptocurrencies have “some parallels to fraudulent pyramid schemes.”

Well, after the WSJ news hit, Blankfein took to Twitter to let everyone know that no decision has yet been reached:

Still thinking about #Bitcoin. No conclusion – not endorsing/rejecting. Know that folks also were skeptical when paper money displaced gold.

— Lloyd Blankfein (@lloydblankfein) October 3, 2017

Fast forward a couple of weeks and this is what Blankfein told Bloomberg:

Video Length: 00:02:21

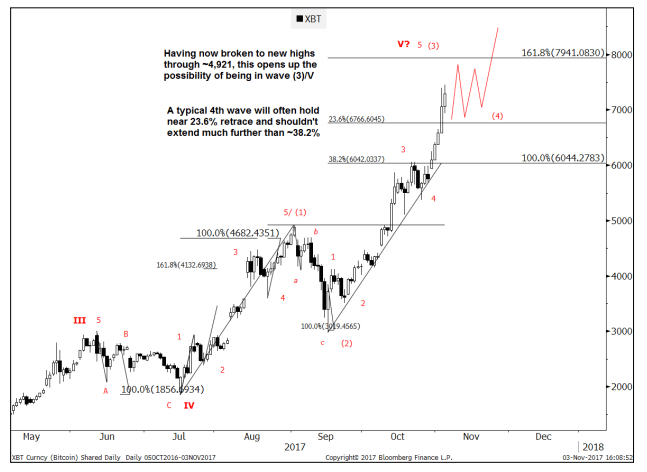

Ok, so that brings us to a “call” that’s making the rounds on Monday. Here’s Goldman’s Sheba Jafari analyzing Bitcoin the only way you can – with lines:

It exceeded an equality target from the July low at 6,044. This break indicated potential for an impulsive advance, one that could reach at least 7,941. This is the minimum target for a 3 rd of 5-waves up and should therefore be a level from which to watch for signs of a consolidation.

It’s important to emphasize that a stall near 7,941 should be viewed as corrective/ counter-trend. A typical 4 th wave will often hold ~23.6% of the length of wave 3; which from 7,941 measures out to ~6,767. Given that this is just a 3 rd of 5-waves up, the implications are that Bitcoin has potential to run further over time (wave 5 of 5).

Leave A Comment