Confirming what we explained here, Goldman Sachs notes that the publication of a new CNY exchange rate index suggests an increased focus on broader CNY moves against other non-USDollar currencies and reinforces the likelihood of further depreciation versus the USD.

Goldman Sachs writes…

“The China Foreign Exchange Trade System (also known as CFETS), a sub-institution of the People’s Bank of China whose main function is organizing the inter-bank FX market, published a new CNY exchange rate index on its website on December 11th. The stated intention of the new index is to help bring about a shift in how the public and the market observe RMB exchange rate movements–emphasizing broader (trade-weighted) currency moves rather than simply bilateral moves versus the US dollar. The PBOC re-posted the CFETS announcement on its own website. In our view, this reinforces the likelihood of moderate depreciation versus the USD, should the broad USD continue to strengthen per our forecast.

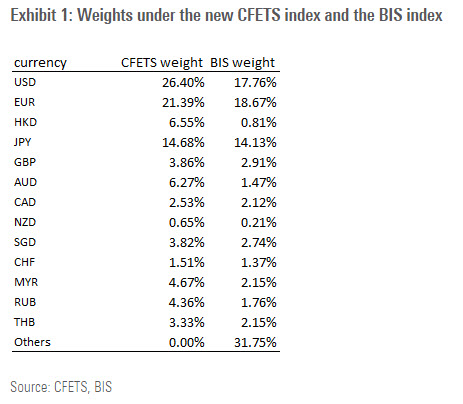

The new index references 13 currencies, with their weights reportedly based on the countries’ importance for China’s trade, after adjusting for re-exports. Compared to BIS’s China effective exchange rate index, which has previously often been referred to in official communications, weights assigned to the USD and EUR are noticeably higher (Exhibit 1)–the total effective weight assigned to the most major currencies (USD, EUR, JPY and GBP, including weight to the HKD in that of USD) is about 73%, compared to 54% in the BIS index. Note that CFETS mentioned yesterday that it would also start publishing CNY exchange rates based on the BIS basket and the SDR basket.

Since the decision by the IMF Executive Board to include the RMB in the Special Drawing Rights Basket on November 30, the authorities have more clearly allowed a weakening of the currency. The depreciation also followed the recent rise in the euro (vs. USD) in light of the less dovish than expected ECB move on Dec 3rd–this development caused the RMB TWI to ease on the margin, and all else being equal, might help mitigate the market sell-off pressure on the currency. Nevertheless, the recent rise in onshore CNY trading volume and widening of the CNH-CNY gap suggests that FX outflow might have picked up (Exhibit 2), likely reflecting increased expectation of RMB depreciation against the dollar as the weakening trend became visible.

Leave A Comment