One wouldn’t know it by looking at the moves in equity indexes, but this earnings season has been unusually volatile for stocks, which however has yet to translate into bigger moves at the macro level. That is the bizarre observation made by Goldman’s derivatives strategist John Marshall (whose team grew by one when ex-Deutsche Banker Rocky Fishman joined recently).

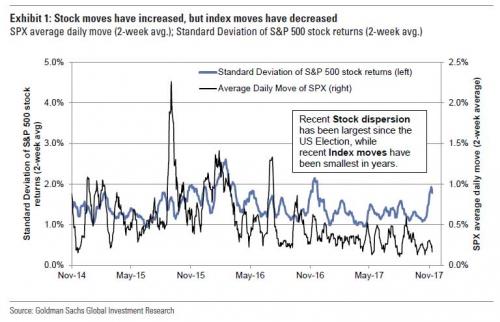

As Goldman shows in the chart below, while earnings day moves have increased in the US and globally, and stock dispersion generally has jumped to the highest since the Trump election, index moves have been the smallest in years. Goldman believes this is further evidence “of increased uncertainty in the equity market.”

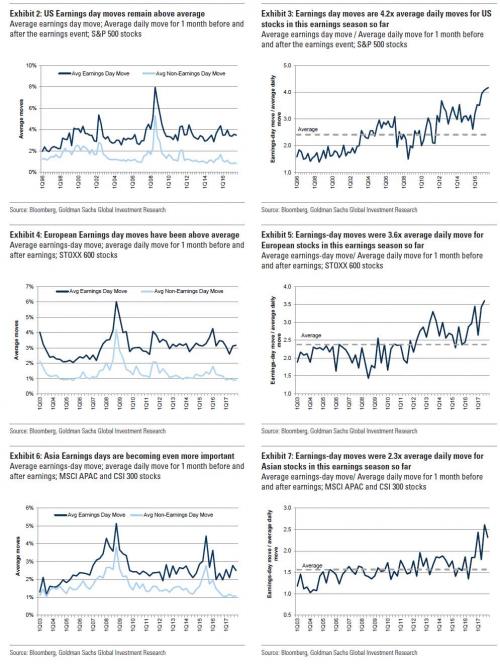

Quantifying the delta between the two vol indicators, Goldman writes that over the past two weeks, the SPX has moved an average of 0.17% per day (1-standard deviation BELOW its 3-year average), while looking under the hood at the stocks in the S&P 500 the standard deviation of returns has been 1.8% on average (1-standard deviations ABOVE its 3-year average). As an indication of just how much turblience there is below the surface, earnings day moves are 4.2x average daily moves for US stocks (3.6x for European and 2.3x for Asian) in this earnings season so far.

Using the charts below, Goldman shows the earnings day absolute move in stocks relative to the non-earnings days 1 month before and after. This includes data through November 9, 2017 for the current quarter. Earnings day moves are above average levels relative to the past decade, while non-earnings days have had lower volatility.

What does this bifurcated volatility pattern mean? According to Goldman, “this as evidence that fundamental uncertainty is rising (stock moves on earnings days) while general macro fears have fallen (stock moves on non-earnings days).” In practical terms, and based on the relationship of index volatility and the standard deviation of S&P 500 stock returns over the past 15 years, Marshall writes that he would expect “the SPX to be moving 90bps per day rather than the current 17bps. This implies realized volatility above 15%.” Of course, that may not be possible (or allowed by central banks) because as we wrote two weeks ago, the beta of VIX spot has exploded to -19, which means that even a mere 90bps down day in the S&P could launch a self-reinforcing vol cascade which crushes the millions of vol sellers, unleashing a another sharp correction, or worse.

Leave A Comment