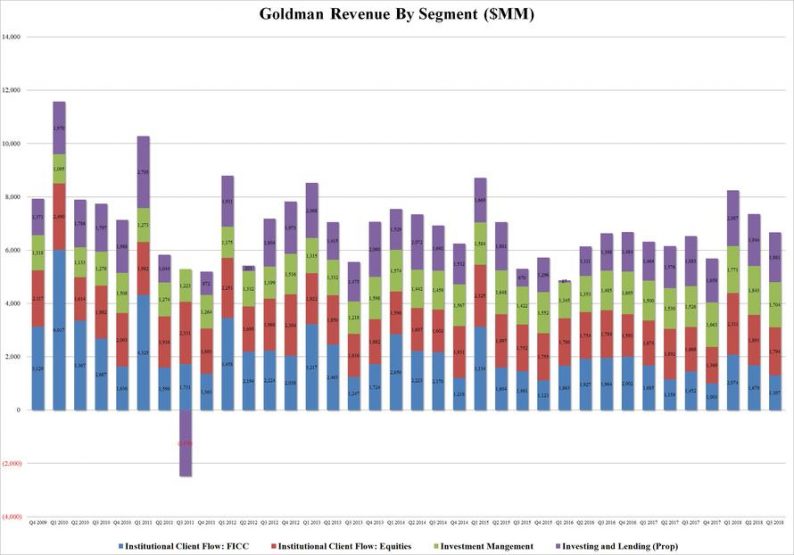

After Morgan Stanley beat across the board, reporting a fixed income number that bucked the trend observed by most other banks and surprised to the upside, Goldman once again failed to keep up with its increasingly more powerful competitor, and despite reporting a strong overall quarter with revenue of $8.65BN beating estimates of $8.37BN, and EPS of $6.28, also higher than consensus of $5.38, the central bank incubator once again disappointed in its core FICC group, as fixed-income trading of $1.31BN, down 10% Y/Y, and missing expectations of $1.45BN.

Commenting on this decline, Goldman blamed the “significantly lower net revenues in interest rate products and lower net revenues in credit products and mortgages” which were “partially offset by higher net revenues in commodities and currencies.” Goldman also noted that during the quarter, “FICC Client Execution operated in an environment characterized by low client activity amid low levels of volatility.”

And while Equity sales and trading was stronger than expected, printing at $1.79BN, up 7.6% Y/Y, and above the $1.73BN expected, total trading revenue of $3.1BN came in just below expectations of $3.12BN. The increase in revenue was due to higher net revenues in equities client execution, “reflecting significantly higher net revenues in derivatives, partially offset by lower net revenues in cash products.”

Commenting on the state of the market, Goldman said that during the quarter, “equities operated in an environment generally characterized by continued low levels of volatility and lower client activity compared with the second quarter of 2018.”

Offsetting the decline in sales and trading was Goldman’s Investment Banking group, which came in at $1.980BN, above the $1.75BN estimate, and 10.2% higher from a year ago. Breaking the number down, bet revenues in Financial Advisory were $916 million, unchanged compared with a strong third quarter of 2017. Net revenues in Underwriting were $1.06 billion, 20% higher than the third quarter of 2017, reflecting significantly higher net revenues in equity underwriting, which came in at $432MM, driven by initial public offerings, well beyond the $300MM expected. This increase was partially offset by lower net revenues in debt underwriting, reflecting a decline in investment-grade activity. Additionally, Goldman noted that its investment banking transaction backlog was lower compared with the end of the second quarter of 2018, but was higher compared with the end of 2017,

Leave A Comment