Once again, Jefferies’ one-month early glimpse at Wall Street trading revenues proved to be spot on. After the boutique mid-market banks reported a total collapse in fixed income trading revenues (which ended up negative following massive charge offs), everyone was looking at the biggest hedge fund among the TBTF banks – Goldman Sachs – to see just how bad the trading environment really is. The answer came moments ago, and the answer is bad. Very bad.

First the headline numbers: both headline EPS of $2.90 and adjusted EPS of $2.64 missed the consensus estimate of $3.00, which was the first Goldman EPS miss in 12 quarter, while Goldman’s revenues did no better, printing at $6.86 billion, below the $7.07 billion estimate, revenue which was not only an 18% drop from a year ago, but also matches the worst quarterly revenue Goldman has generated since 2011!

Amazing how things change when one can’t simply frontrun central banks with impunity, and yes – Tepper was right.

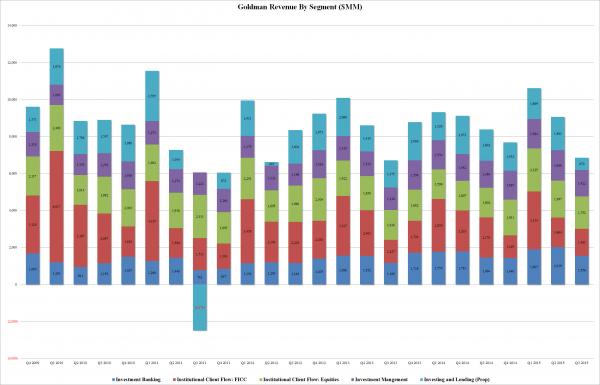

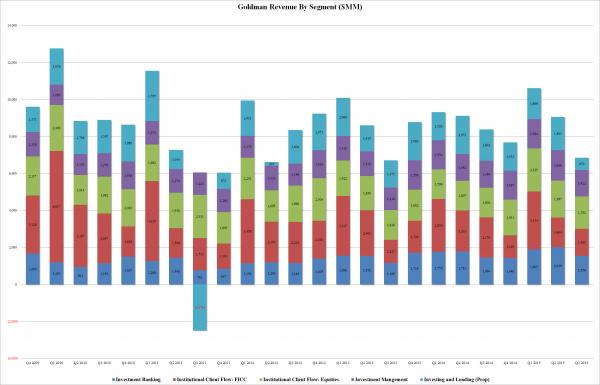

The chart below lays out the details:

First the good news: both Investment banking, at $1.6 billion in revenue and institutional equities, at $1.75 billion, posted Y/Y increases of 6.3% and 9.4%, respectively. The banking rise was to be expected, with Goldman remaining the underwriter of choice for most IPOs and debt offerings, as well as the go to advisor for M&A deals and various corporate buybacks.

The bad news however was dramatic: everyone expected FICC would be down, but plunging 33% to $1.46 billion from $2.2 billion a year ago was certainly a surprise. Because if even Goldman can’t make commissions on moving bonds, commodities and currencies, then the environment has gotten beyond illiquid. Thank the HFTs and the central banks.

Even worse, however, was Goldman’s own prop book (yes, the FDIC-insured hedge fund still has a prop trading operation despite the Volcker Rule, only it calls it Investing and Lending now instead of by its old name “Prop trading”), which plummeted by a whopping 60% from $1.7 billion a year ago to a paltry $670 million. This was the lowest revenue Goldman’s prop trading group has generated since Q2 2012 and bodes very badly for the future of not only banks but hedge funds. Because if Goldman, which has spawned more central bankers than any other bank, can’t make money trading its own book in this environment, nobody else can.

Leave A Comment