Should you “trust” (and I don’t even know what that means here because in your capacity as a market participant “you” were involved in creating the reaction) the market’s dovish interpretation of the Fed?

More than a few people have suggested that the answer is “no” – or at least “probably not.” “[The] market reaction to yesterday’s Fed announcement was somewhat bizarre,” Bloomberg’s Cameron Crise wrote on Thursday morning, adding that “after all, there was nothing in the guidance (and little in the press conference) to justify a rally in short rates.”

Right. And that seemed immediately obvious. Some of yesterday’s move was attributable to the lackluster core CPI print we got earlier in the day, but the rally accelerated “bigly” during the presser. It’s reversed since and given the above, that seems rationale.

Well for their part, Goldman agrees that markets got this one wrong. To wit, from their Fed follow-up:

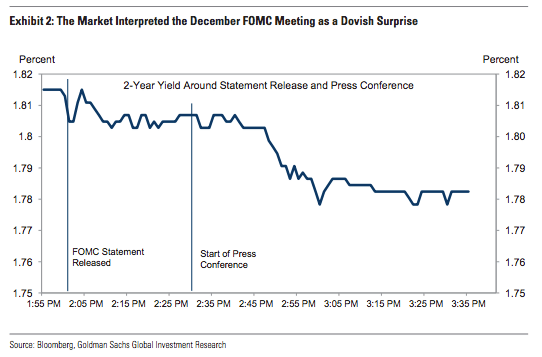

The fixed income market rallied following the release of the FOMC statement and during Chair Yellen’s press conference, and many market participants seem to have taken the December meeting as a dovish surprise.

Many viewed the combination of a sizeable upgrade to the growth numbers and no upward movement in the 2018 and 2019 dots as an indication that the FOMC has now mostly accounted for the impact of the tax cuts, but did not feel that their impact warranted additional tightening, at least over the next two years.

Long story short, Goldman thinks that’s a mistake. In their mind, the Fed is fudging the numbers in order to avoid projecting further overheating in the labor market (they don’t put it in those terms, but that’s the gist of it). To wit:

The median projection now shows GDP growth a cumulative 1.2pp above longer-run potential beyond this year and even further above backward-looking estimates of potential, but it has the unemployment rate declining only 0.1pp further through the end of 2020

[…]

The very limited further decline in the unemployment rate likely reflects the FOMC’s sensitivity about showing an even larger overshoot of full employment.

Leave A Comment