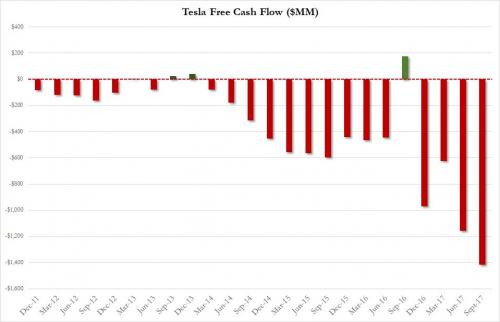

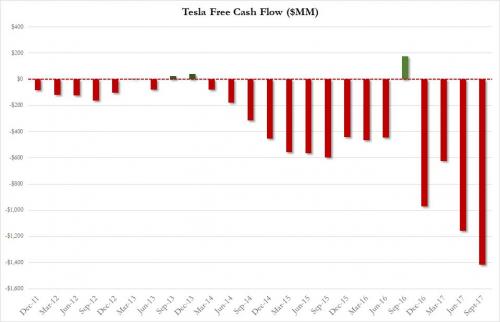

One day after Tesla announced its worst quarter in history, in which it burned a record $1.4 billion in cash…

… Goldman has guaranteed it will not be an underwriter on the next Tesla stock offering – which at the current cash burn will take place in less than 2 quarter – by reiterating its Sell rating on Tesla, and cutting its Price Target to $205, or 36% downside. Here is the summary from Goldman’s David Tamberrino who once again unapologetically throws up all over the latest TSLA earnings:

We reiterate our Sell rating on shares of TSLA. We believe the stock should continue to de-rate following 3Q17 results where the company further pushed out its Model 3 production targets for 5k/week to late 1Q18. We believe this further pushes out the potential to ramp to 10k/week production of the Model 3 to at least 2019 (though we continue to model a ramp well below both); this should weigh on gross margins through at least 1Q18 and we do not expect a return to above 20% Automotive gross margin levels until 2H18. Altogether, we believe this indicates that the company’s goal for positive OCF generation should remain elusive until the middle of 2018 — though we still forecast significant FCF burn. On that front, we now believe TSLA will need to raise capital sooner (2Q18 vs. 3Q18 previously). Lastly, we believe the company’s comments on potential China production (3 years out) will be disappointing to investors, which have been confident in TSLA entering the China market with local production in the next one to two years. Our 6-month price target declines to $205, showing 36% downside.

And some more details:

Meanwhile, even as stormy weather gathers in longsville…

Stormy weather in Shortville …

— Elon Musk (@elonmusk) April 3, 2017

… and the stock tumbles, there is a long way to fall for Tesla before it hits Goldman’s $205 price target.

In the meantime, Tesla Bonds are crashing too.

Leave A Comment