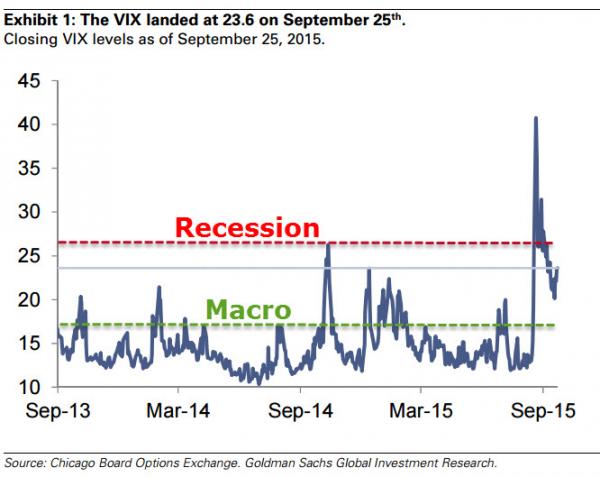

VIX is “searching for a new home” according to Goldman Sachs as the current elevated level of implied risk lies at the high side (around 24) of the current business cycle (~18) and recession-esque volatility (~26) range. Current options prices imply a 7% chance of a 10% crash in the next month and uncertainty is running twice as high ahead of this week’s jobs data than on a normal payrolls week…

The VIX is searching for home. An indecisive VIX curve is waiting for data.

Clarifying comments from Fed Chair Janet Yellen, an upward revision to second quarter U.S. GDP to 3.9% and a higher than expected increase in consumer spending were still not enough to hold the market up last week. The S&P 500 was down 1.4% last week and the VIX landed at 23.6. The VIX has averaged 22.4 over the last week and that is an interesting level.

An indecisive VIX is searching for a new home: Relative to the current levels of ISM, employment, and consumer spending we estimate baseline VIX levels of 18. 26 is the median daily VIX level over the last three recessions. An average VIX level around 22 over the last week is therefore midway between our business cycle estimate for the VIX and the median VIX level over the last three recessions. That is about as indecisive as the VIX has been in years. The VIX is searching for a home.

A flat VIX term structure also points to an indecisive vol market waiting for data.Oct-15 to Apr-16 VIX futures are also all within a vol point of 22. In the good times, the VIX term structure is upward sloping. When equities are at their worst the term structure becomes inverted, with the VIX much higher than the VIX futures. A flat term structure with no momentum in either direction signals extreme indecision, in our view.

While the economy may suggest VIX levels in the high teens, a primary take-away is still that baseline volatility levels have shifted at least 4 points higher than average VIX levels in 2014 (14.2). While we wish the VIX a speedy recovery, in our view an indecisive VIX is justifiable. The market is searching for improvement in U.S. and global data. We get ISM and payrolls this week.

Leave A Comment