You know the expression: “Get in, strap down, shut up, hang on!“ For the agonizing narrow road upon which Gold has been slowly trudging these recent weeks is due to suddenly widen into a superhighway. And there’s no week like this new week for it to happen. But here’s the key question: in which direction?Up or down? Doubtless in a week’s time we shan’t find Gold where it settled yesterday (Friday) at 1314.

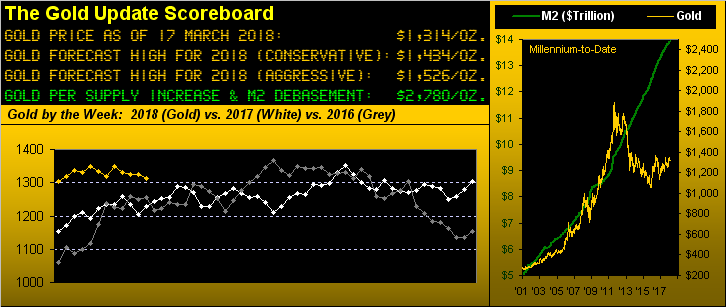

From our “preaching to the choir department”, we view Gold’s main upside driver as the broad-based debasing of currencies, the inevitable result of too much dough, debt and derivatives. Gold generally benefits as well from the “U-word” — Uncertainty — of which there seems a burgeoning plethora here, there and everywhere over this, that and the other thing. And yet, for all the world, Gold throughout these recent weeks has been dead in the water.

So much so that of the 11 trading weeks year-to-date in 2018, Gold has traded in the 1320s during 10 of them. Cue for the umpteenth time Chris Isaak’s ‘Goin’ Nowhere’.

With that in mind, Gold time and again goes from being a narrow trade to one swiftly swayed. Already priced into Gold is this week’s Federal Open Market Committee announcement come Wednesday, March 21, of their Bank’s Funds Rate being up-shifted to the 1.50%-1.75% target range. But as they say, “the devil’s in the details”, and not just from those in the policy statement, but as well from those to emanate from Fed Chairman Powell as he faces the press for the first time post-statement. All of which brings us to the “perfect timing” for some serious price sway per this chart: from one year ago-to-date these are Gold’s weekly trading ranges. When the range gets as low as is now currently shown, narrow then goes wide every time:

But remains the question, in which direction? As much as we’re rooting for “up” on the old quip “sell the Fed rumor, buy the Fed news and leave them all confused“, neither from a technical basis can we rule out “down”. Here’s one view why as we turn to Gold’s weekly bars: the rising blue dots of parabolic Long trend now only allow for 23 points of downside wiggle room without flipping said trend to Short: just an intra-week drop of 1.8% will be enough for that to trigger.

Leave A Comment