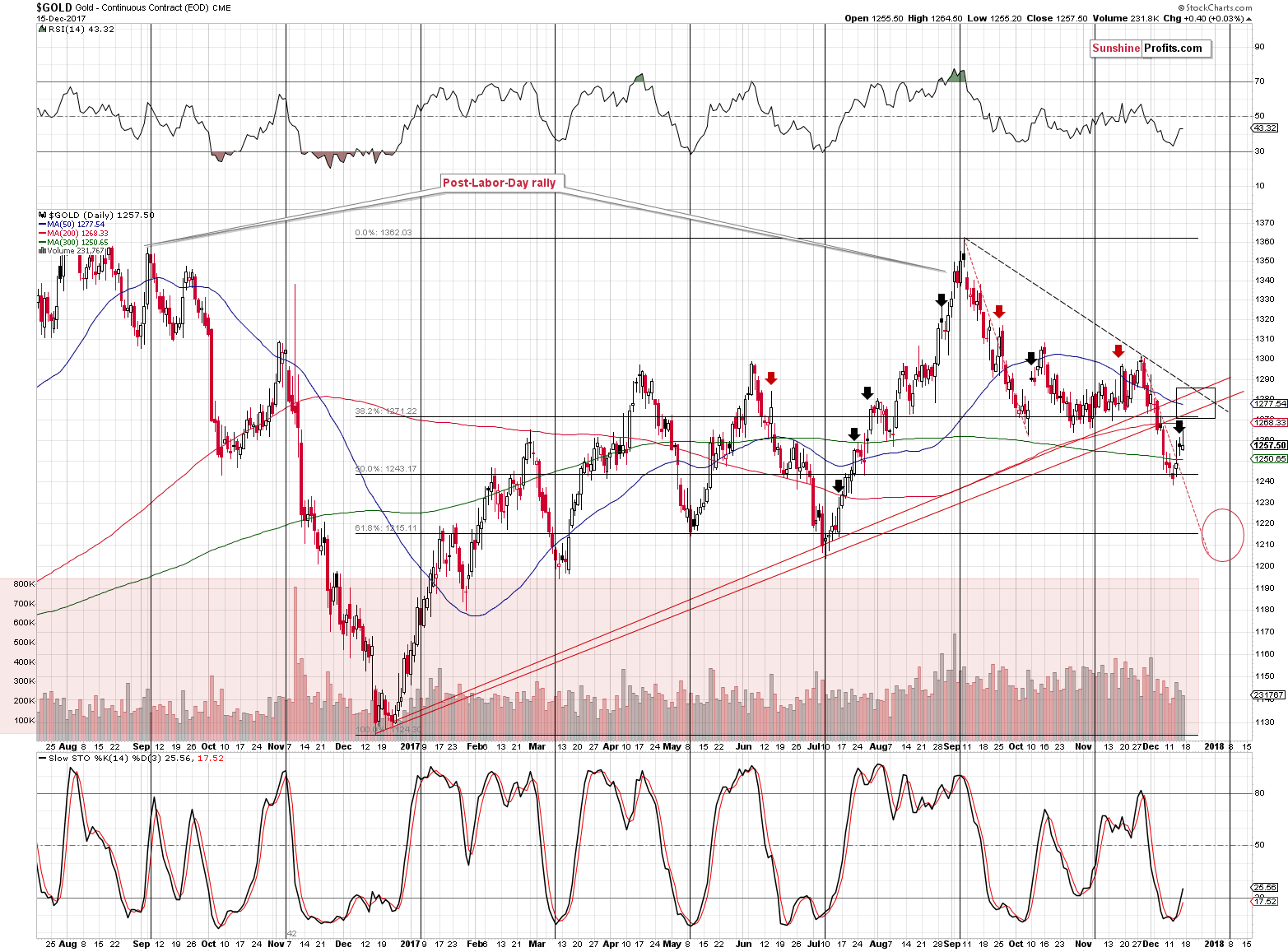

After three weeks of declines, gold finally moved higher last week. Was this move surprising? Not at all, if you read our analysis of the previous week’s huge decline in platinum. The sizable slide in the latter was likely to trigger at least a small rally and that’s what we saw last week. However, gold reversed quite clearly on Friday and shooting star candlesticks, as these sessions are called, are signs of a reversal. Did we see one?

That’s not likely. There are several reasons not to believe the shooting start in gold. Let’s take a look at yellow metal’s chart for details (charts courtesy of StockCharts).

The reversal is a fact, but it is also a fact that the shooting star candlestick should be confirmed by huge volume. Instead of huge volume, we saw rather average and declining daily volume levels. Consequently, the bearish implications of the candlestick pattern don’t seem to really apply.

We explained the importance of confirmations in the November 21 Alert, but – in light of the above – it seems that quoting it might help. Back then we described it with regard to a breakout in silver and its subsequent invalidation, but the explanation regarding volume applies also to reversals.

As we’ve often emphasized, invalidations of breakouts are effective immediately and are quite strong signals that the move in the other direction is about to follow.

If you’ve been wondering why this is the case, here’s an explanation. If the market moves over a given resistance then this move could be accidental or it could be a true show of strength. What we want to see is signs that would confirm that there has been a “battle” for a given breakout and that the bulls have won this battle. A fierce battle means that a lot of capital was used and we would see high volume levels as a confirmation (that’s why a huge volume reading can confirm a breakout or breakdown on its own). But, what if the market was somehow forced to move higher (for instance gold could rally given a big plunge in the USD as the latter would make it cheaper in terms of other currencies and if the demand didn’t change overall, lower prices would attract more buyers), but it really doesn’t want to rally? That’s why we use the 3-day confirmation rule. If the move was artificial in some way, the market participants are likely to push the price in the original direction. Naturally, if the markets that usually confirm each other’s moves all breakout or break down at the same time it further increases the odds that the move is true.

Leave A Comment