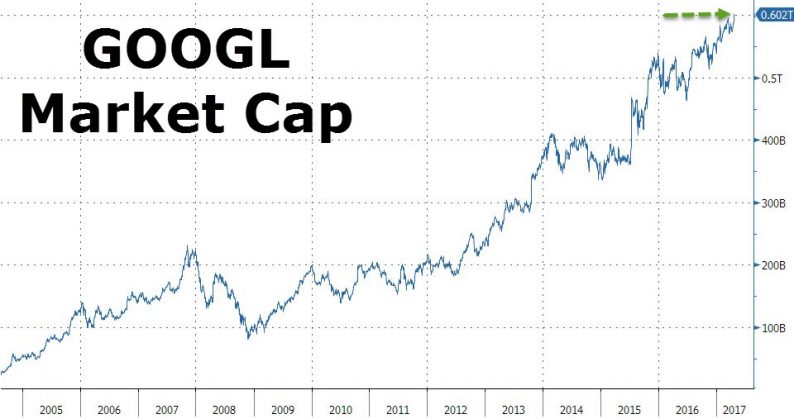

Even as the US “brick and mortar” retail industry is in a tailspin of historic proportions, its ad spending must be better than ever, because on Monday Google parent Alphabet closed up 2.3%, hitting a new record high, and as Bloomberg pointed out first, the company’s market value crossed above $600 billion for the first time ever.

Investors chose not to wait for GOOGL earnings due later this week, and bought up shares ahead of the announcement driven by positive analyst comments ahead of 1Q results on April 27 and as the S&P North American tech index rose 1.4% with broader markets rallying.

Whether ad spend, and earnings, will justify GOOGL’s astronomic market valuation, second only behind AAPL, will be revealed later this week, but for now it remains clear that just five tech companies – the biggest ones – namely Apple, Google, Microsoft, Amazon and Facebook remain the backbone of the entire stock market, and carry the weight of much of the stock market on their shoulders.

As CNBC noted recently, Apple is up over 23% year to date, Google parent company Alphabet is up over 10 percent, Microsoft is up over 6%, Amazon has soared over 20% and Facebook is up over 25% just in the past four months. The relentless strength of these tech titans is why the overall market has been so solid in recent months. Meanwhile, some 130 stocks in the S&P 500 are trading below their 200 day moving average.

Leave A Comment