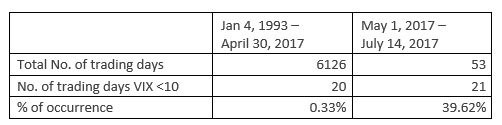

Tuesday the Dow fell because of weakness from Goldman Sachs (the Dow is price weighted and Goldman has a high price) while the other indexes were mixed. Ignoring today’s action and focusing on the last few weeks of trading, there’s no question the market has been unusually quiet. As you can see from the chart below, the VIX being below 10 has gone from a very rare event to a common occurrence. Many investors who started before 2008 get scared of this chart because they feel it’s the calm before the storm. I’m not worried about this at all because low volatility doesn’t mean more is coming soon. At some point in the indefinite future, the VIX will likely be higher, but there needs to be a catalyst for the change to happen soon. Strong earnings for the time being means more of the same boring trading for the next few months.

The reason why I follow the VIX is it has great predictive power. As you can see from the chart below, the blue lines are bands the S&P 500 is supposed to fall within based on where the VIX is at. The green line shows the 1-month actual S&P 500 returns. The returns almost always fall within the bands and they are usually tight when the bands are narrow. It’s often discussed that the VIX is a terrible measure of intermediate term systemic risk. I have mentioned this to show that the risk in the next 2 years isn’t diminished by a low VIX. For example, the VIX was low in 2007. However, it was also low in the 1990s and nothing bad happened then. The key is to recognize what the VIX does well. It predicts 1-month performance not 2 year performance.

The chart below is a survey by BAML which makes the same point I have been making previously. The last answer is the percentage of investors who think a delay in corporate tax reform is the biggest risk which can push stocks down. As you can see, the number has fallen from 14% to 4% as investors have moved on from expecting tax reform to be a boon for stocks. Maybe they are right as 2 more GOP senators recently defected from the latest healthcare bill. However, I still think Mitch McConnell will use all the negotiating skills he has acquired over the years to get something done. The latest news in this saga is that Mitch will try to pass a bill which repeals Obamacare after a 2-year waiting period and tacks on amendments to get rid of the parts of Obamacare the GOP doesn’t like.

Leave A Comment