Introduction

From reading the media, one gets the impression that bailing out its banks is the most serious economic problem the Eurozone faces. This problem could easily be avoided. As I have explained elsewhere, not allowing banks to sell off loans they make would resolve this problem.

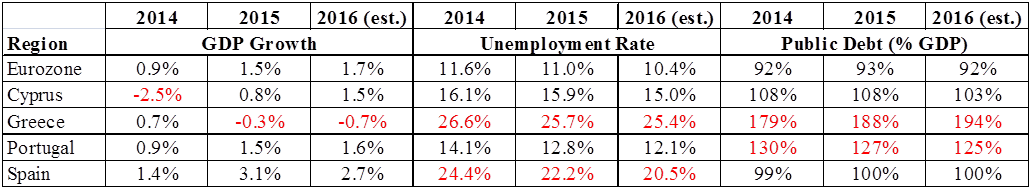

But bank problems aside, the Eurozone countries appear to doing better. According to FocusEconomics (Table 1), the aggregate GDP growth rate for the region was 1.5% in 2015 and is projected to increase to 1.7% in 2016. Of course, this is hardly impressive as compared to the US with an actual and projected growth rate of 2.4% for both 2015 and 2016. But keep in mind that the Eurozone’s GDP declined in both 2012 and 2013 due to the “weak sister” performance of Cyprus, Greece, Portugal and Spain. Positive growth for the region started in 2014 and continues.

Table 1. – GDP Growth, Unemployment, Debt, 2014-16

Source:

The “weak sisters” appear to be doing somewhat better. Cyprus, whose GDP fell in 2014, now seems to be progressing. Spain’s unemployment rate remains high, but its projected GDP growth in 2016 should help. Portugal has a worrying level of debt but growth also there has picked up.

Greece

And then there is Greece. GDP fell in 2015 and is projected to fall again in 2016. Since 2008, its GDP is down 27%. Unemployment remains high with and youth unemployment is just under 50%. And then there is its government debt. The IMF repeatedly says it debt rate is unsustainable, but the Euro countries have shown little interest in dealing with it. And once again, street protests are on the rise. And Greece has the additional burden of being a major entry point for migrants from the Middle East into the Eurozone.

One does wonder what form the resolution of the Greek crisis will take.

To get a handle on the problems facing Greece, the following selections from the IMF’s “Sustainability Analysis” summarized below are helpful (comments in brackets [ ] are mine):

Leave A Comment