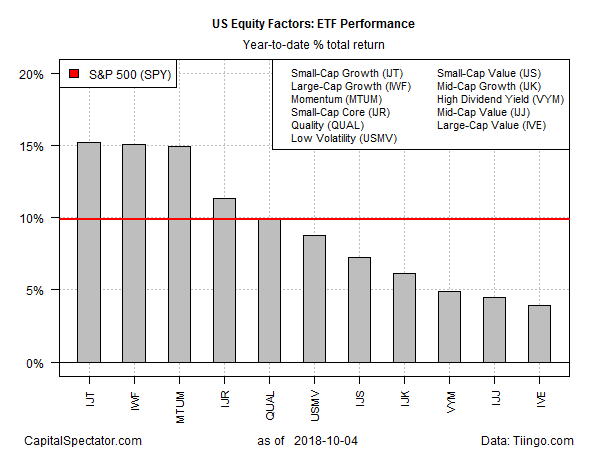

Yesterday’s sharp sell-off in US stocks delivered haircuts far and wide, but the setback left growth and momentum factors in the lead for year-to-date equity performance, based on a set of exchange-traded funds (ETFs). While large-cap value suffered the smallest loss in yesterday’s rout among the major equity factor buckets, this slice of US equities remains in last place in 2018 through yesterday’s close (Oct. 4).

Three factor ETFs are essentially tied for first place in the year-to-date horse race, representing small-cap growth, large-cap growth, and a fund targeting momentum. At the top of the list is iShares S&P Small-Cap 600 Growth (IJT), posting a 15.2% return this year, followed by iShares Russell 1000 Growth (IWF) with a 15.1% gain and iShares Edge MSCI USA Momentum (MTUM), which is ahead by 14.9%. This trio is enjoying a relatively strong run vs. the rest of the field.

The weakest factor performer so far this year is large-cap value. The iShares S&P 500 Value (IVE) is up a modest 3.9% in 2018 through yesterday’s close.

For perspective, the broad market is ahead by 9.9% on a year-to-date basis via SPDR S&P 500 (SPY).

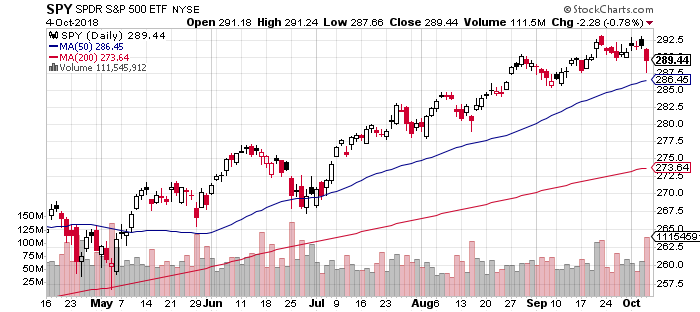

Despite the latest swoon in prices, the technical profile of the broad market remains upbeat. For example, the SPDR S&P 500 closed yesterday well above its 50- and 200-day moving average and the 50-day average remained far above the 200-day average.

The economic backdrop also remains positive. As reported earlier this week,recent nowcasts point to a healthy 3%-plus increase in US GDP for the upcoming third-quarter report that’s due at the end of this month.

Today’s release of the nonfarm payrolls report for September is expected to support the upbeat outlook for Q3 macro data. Econoday.com’s consensus forecast calls for companies adding 175,000 jobs, which translates into a slightly faster year-over-year gain: 2.0%, the strongest annual rise in over two years, if the forecast is correct.

Leave A Comment