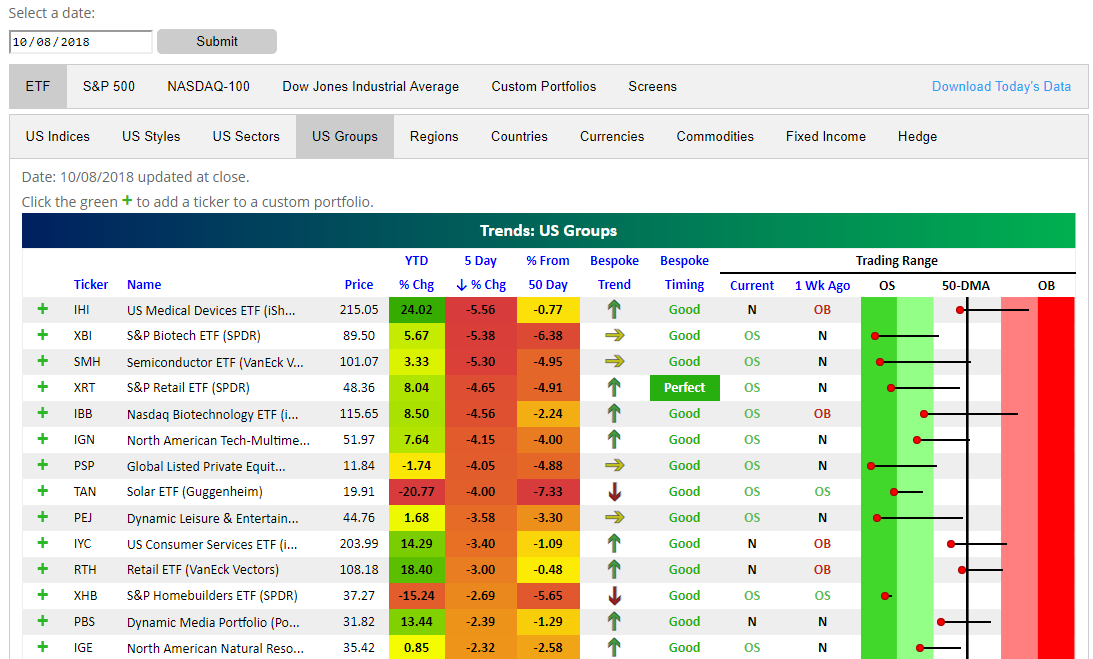

The US has had a rough go of it the past week, which we can explore using our Trend Analyzer. The past few days have seen many indices close lower; namely, the growth groups. Even though many have seen significant gains YTD—US Medical Devices (IHI) is up 24.02% and Retail ETF (RTH) is up 18.4%—in the past week, there has been a rotation out of these names. These groups are plummeting now as the market takes a breather. Even though it is one of the strongest ETFs on the year, IHI has fallen the most over the past 5 days out of all US groups. S&P Biotech (XBI) and the Semiconductor ETF (SMH) are not far behind. All three of these are down over 5% in the past week. Impressive to note though, even falling as much as it did, IHI has not entered its respective oversold territory. Unfortunately, this is not the case with the rest. These large moves since the beginning of October have pushed most growth ETFs deeply oversold.

Investors seem to be rotating into Financials and Energy as well as safe assets like gold and real estate. This comes on the back of rising rates and oil prices over the past week. The S&P Regional Banking (KRE) has had the strongest gains of 2.16% over the past 5 days. Insurance (KIE), Exchanges (IAI), Financial Services (IYG), and Mortgage Real Estate (REM) have each seen gains following news of higher rates. Right behind KRE for the largest gains is Junior Gold Miners (GDXJ) rising 1.75% over the same time. This is one of the worst underperformers on the year as gold has fallen consistently. Gold Miners (GDX) while not seeing as large of gains over the past week is seeing a similar pattern. Fears of what’s around the corner seem to have had investors shift out of growth and into safer assets like gold, while higher rates are making financials more attractive.

Leave A Comment