I have commented for months that soft economic data from various diffusion indexes does not match actual economic activity.

Some highly touted soft measures never match economic data except by accident. Consumers sentiment is the prime example.

Yet, once again, most of the investment community believes in the strong “second-half recovery” theory instead of looking for reasons why soft data is not going to harden.

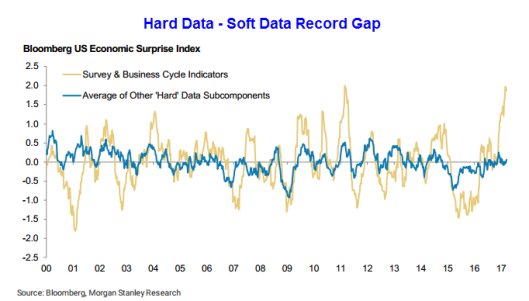

Record Gap Between Hard and Soft Data

Financial Times writer Gavyn Davies asks Global surveys or hard data – which are the fake news?

Davies says “The inclusion of survey or soft data in nowcasting models is crucial to improve the accuracy of the signals produced by these models in real time.”

He concludes that hard data understates growth and expects a much stronger second quarter.

Economic Noise

John Hussman has a different conclusion. Hussman proposes that this late in the cycle, soft data is typically noise.

Hussman’s weekly column, Echo Chamber, dives into the economic egg debate.

Crackings the Shells

I can see how soft data might smooth out forecasts. But what is it really measuring now?

The sentiment measures are a joke. Close scrutiny proves sentiment measures stock market performance, not expected measures of consumer spending.

For discussion, please see Consumer Sentiment Statistical Noise: Modern Day Snake Oil

Although everyone touts the ISM report, what about Markit’s PMI report? The Markit and ISM reports are two soft measures of the same thing. While ISM estimates 4.3% first quarter GDP, Markit suggests 1.7%.

Thus, not even the soft data is uniformly strong.

Auto Sales and Plunge in GDPNow

In regards to auto sales and the plunge in the GDPNow estimate I received this reply from Pat Higgins, the creator of GDPNow:

Hi Mish

Thanks for forwarding me your blog link and the positive feedback.Regarding your question, almost all of the decline on April 5 was due to auto sales rather than the ISM Nonmanufacturing Index.If one uses the April 4th estimate of the model’s dynamic factor with the April 5th estimate of auto sales, the model forecasts for real business equipment investment and real PCE goods good are only about 0.1 percentage point higher than their April 5th levels provided in the GDPNow spreadsheet.Real PCE goods growth fell from 2.5 percent to 1.2 percent on April 5th and real equipment investment growth fell from 9.7 percent to 6.4 percent on the same day.These subcomponent declines were responsible for most of the model nowcast decline on the 5th.

Best regards,

Pat

Leave A Comment