Well, if you were looking for the silver lining in the catastrophic flooding that accompanied Hurricane Harvey, Goldman is happy to oblige.

As expected, analysts of all stripes have bent over backwards this week to try and quantify the impact of the storm on whatever sector or asset class they happen to cover although it goes without saying that’s an exercise in futility in the near-term.

Assessing the fallout from this will take months and probably years depending on what it is you’re trying to determine.

But when it comes to the effect it will have on the odds of a government shutdown, things are a little easier to measure by virtue of the fact that those odds are to a large extent subjective in the first place.

You might recall that over the past couple of weeks, Goldman has pegged the odds of a shutdown at roughly 50%. And that brings us to the silver lining of Hurricane Harvey: the odds might have fallen simply because no one will want to risk being the guy/gal that gets blamed for crippling the government’s capacity to provide aid in the aftermath of a horrific natural disaster.

“At this point, we peg the probability of a shutdown in early October at 35%, down from our prior view of 50% over the last couple of weeks [with] the main issue [being] Hurricane Harvey,” Goldman writes, in a note out Tuesday evening. The bank continues: “Allowing a partial government shutdown when federal relief efforts are underway would pose greater political risks than under normal circumstances, raising the probability that lawmakers will find a way to resolve disagreements.”

And it gets better, where “better” means there are knock-on effects for the debt ceiling debate as well. Here’s Goldman again:

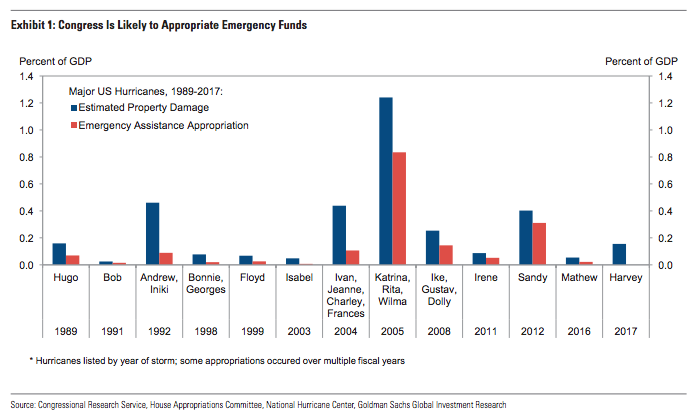

In addition, the Federal Emergency Management Agency (FEMA) will soon need additional funding. The Disaster Relief Fund (DRF), which is the primary source of funding for FEMA’s efforts, has a balance of $3.3 billion and this is likely to be drawn down fairly quickly over the coming weeks. For example, DRF outlays in the month following Hurricane Katrina (occurred August 2005) were a bit less than $5 billion. Katrina-related flood insurance outlays did not start in earnest until October. Non-FEMA spending has typically accounted for around half of the total of federal funds spent on prior hurricane relief efforts, with the Departments of Housing and Urban Development, Defense, Transportation and the Army Corp of Engineers accounting for most of this, but we would expect these outlays to take longer to ramp up. We expect Congress to provide additional funds in September; over the last 30 years or so, Congress has passed legislation anywhere from a few days to a month following previous major hurricanes.

Leave A Comment