Hasbro Inc. (HAS – Free Report) posted mixed fourth-quarter 2017 results, with earnings surpassing the Zacks Consensus Estimate and revenues lagging the same.

Adjusted earnings of $2.30 per diluted share surpassed the consensus mark of $1.82 by 26.4%. Earnings grew 40.2% from the year-ago quarter on benefits from the recent U.S. tax reform.

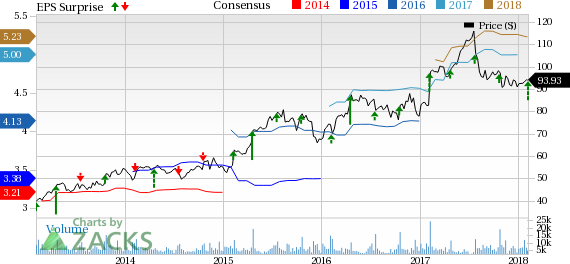

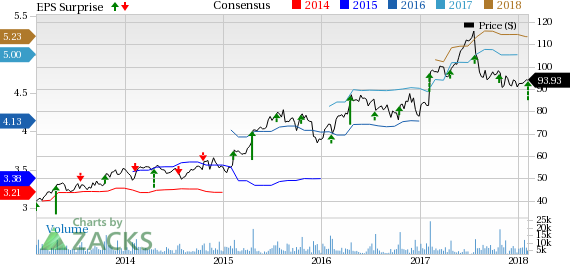

Hasbro, Inc. Price, Consensus and EPS Surprise

Hasbro, Inc. Price, Consensus and EPS Surprise | Hasbro, Inc. Quote

Net revenues totaled $1.60 billion, missing the consensus mark of $1.73 billion by 7.5%. Revenues also fell 1.8% year over year.

Revenues from its Partner Brands and Europe declined in the fourth quarter which significantly affected net revenues. However, strength in the franchise brand revenues drove the top line. Management believes that product innovation and digital initiatives will help the company gain traction in 2018 and beyond.

Notably, shares of Hasbro have lost 1.1% in the past year, underperforming the industry’s gain of 47.1%.

Brand Portfolio Performances

The Franchise Brand portfolio posted revenues of $764.2 million, up 11% year over year driven by revenue growth in NERF, TRANSFORMERS, MY LITTLE PONY, and MONOPOLY.

Partner Brand revenues decreased 21% to $342.9 million owing to decline in STAR WARS, YO-KAI WATCH and DISNEY FROZEN, which was partially offset by increase in BEYBLADE, MARVEL, and SESAME STREET.

The Hasbro Gaming revenues declined 4% year over year to $343.3 million.

Emerging Brands revenues declined 5% year over year to $145.7 million.

Operating Highlights

Hasbro’s cost of sales, as a percentage of net revenues, increased 50 basis points (bps) to 39.4%.

Meanwhile, selling, distribution and administration expenses ratio declined 220 bps and royalty expense ratio fell 60 bps.

Additionally, operating profit, as a percentage of net revenues, increased 130 bps year over year to 17%.

Leave A Comment