European financials have been one of the most hated areas of the market for years. Investors have been jumping ship and moving capital to a more productive place. It’s just too hard for these banks to make money with interest rates so low.

But the bear thesis dies once interest rates reverse trend. With higher interest rates, banks can lend again for a fat profit. If interest rates in the Eurozone reverse course, we could see a major rally in these beaten down banks.

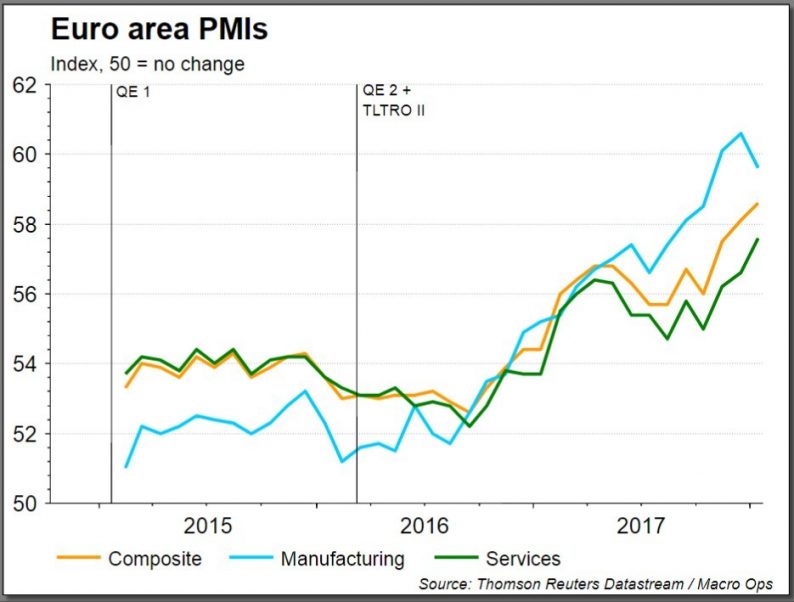

Right now, there’s a huge disparity between where European interest rates are trading and the improving economic backdrop in the Eurozone.

The German 10yr is currently trading for a measly 50bps. This is over 200bps lower than comparable US rates. While at the sametime, it can be argued that the economy in Europe is just as good, if not better than the US.

The eurozone PMI recently came in at 60.6. This marks the strongest pace of economic expansion since the series began in 1997. And country specific PMI’s printed at all-time highs for Austria, Germany, Ireland, and the Netherlands.

The charts for Barclays (BCS), Credit Suisse (CS), Banco Santander (SAN), and Deutsche (BCS shown on the chart below) all look very constructive.

Barclays reminds me of where Deutsche was in 2016. It was the most hated of the big banks. It was being investigated for a number of misdealings, it’s capital cushion was low, and it had a bunch of bad loans on its book. Everybody was predicting its collapse…

I remember tweeting in September of 16’ that I thought all the bad stuff was already priced into DB and the stock was now a great contrarian long. A number of people replied to let me know how ignorant and wrong I was… The stock put in its bottom that week and is now up 60%.

That’s where Barclays is now. It’s got a whole range of issues. It’s CEO, Jes Staley, is under investigation by UK and US regulators for attempting to unmask a whistleblower. And the bank faces potential heavy fines for possibly illegal fundraising for Qatar and mis-selling mortgage securities in the lead up to the GFC.

Leave A Comment