The Advance Report on Manufacturers’ Shipments, Inventories, and Orders released today gives us a first look at the latest durable goods numbers. Here is the Bureau’s summary on new orders:

New orders for manufactured durable goods in October decreased $2.8 billion or 1.2 percent to $236.0 billion, the U.S. Census Bureau announced today. This decrease, down following two consecutive monthly increases, followed a 2.2 percent September increase. Excluding transportation, new orders increased 0.4 percent. Excluding defense, new orders decreased 0.8 percent. Transportation equipment, also down following two consecutive monthly increases, drove the decrease, $3.5 billion or 4.3 percent to $77.1 billion. Download full PDF

The latest new orders number at -1.2% month-over-month (MoM) was worse than the Investing.com consensus of 0.3%. The series is up 1.0% year-over-year (YoY).

If we exclude transportation, “core” durable goods came in at 0.4% MoM, which was slightly worse than the Investing.com consensus of 0.5%. The core measure is up 7.4% YoY.

If we exclude both transportation and defense for an even more fundamental “core”, the latest number is up 1.2% MoM and up 8.5% YoY.

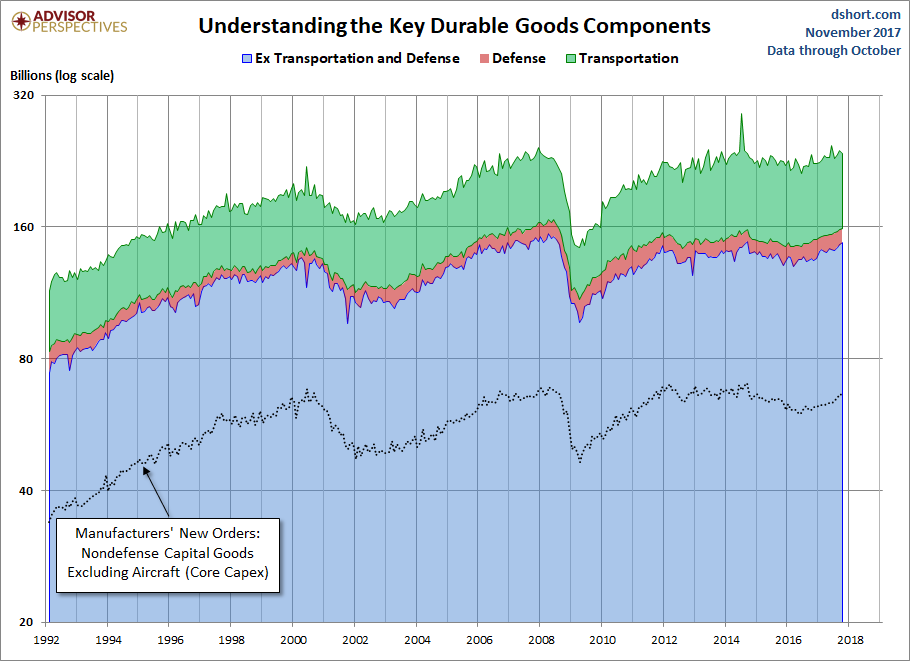

Core Capital Goods New Orders (nondefense capital goods used in the production of goods or services, excluding aircraft) is an important gauge of business spending, often referred to as Core Capex. It is down 0.5% MoM and up 8.1% YoY.

For a look at the big picture and an understanding of the relative size of the major components, here is an area chart of Durable Goods New Orders minus Transportation and Defense with those two components stacked on top. We’ve also included a dotted line to show the relative size of Core Capex.

The next chart shows year-over-year percent change in Durable Goods. We’ve highlighted the value at recession starts and the latest value for this metric.

The next chart shows year-over-year percent change in Core Durable Goods (i.e., excluding transportation).

Leave A Comment