A company with a large and varied product offering needs to stay focused on efficiency to ensure profits do not suffer. As we have detailed in many Danger Zone reports, companies often use hollow acquisition-driven growth to mask deterioration in the underlying business, i.e. efficiency. This week’s Danger Zone stock fits this description to a tee. Add in extremely high profit growth expectations and it’s easy to see why Snyder’s-Lance (LNCE: $35/share) is in the Danger Zone.

Lance’s Business Is Declining Despite EPS Growth

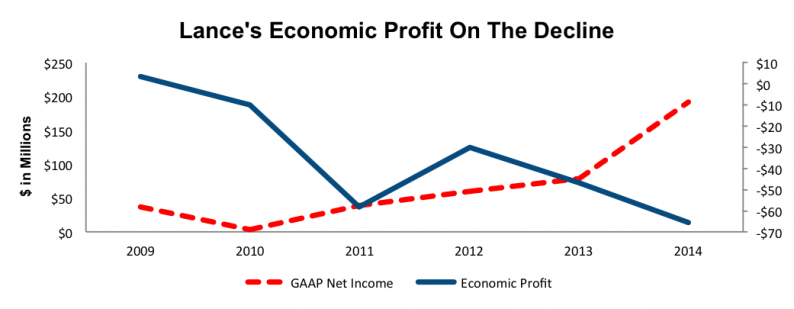

Since 2009, Lance’s business has been headed in the wrong direction despite what EPS may show. Over this time, GAAP net income has grown 40% compounded annually while economic earningshave declined to -$66 million, from $3 million. Figure 1 shows how GAAP net income has created a false picture of Lance’s profits.

Figure 1: Snyder’s-Lance GAAP Net Income Is Misleading

Sources: New Constructs, LLC and company filings

In 2010, Lance merged with Snyder’s of Hanover in an equal stock deal. This new company, which claimed numerous synergies due to their similar operations was supposed to be much more efficient due to increased distribution networks. However, the combined company failed to generate any efficiencies as Lance’s return on invested capital (ROIC) has fallen to a bottom quintile 4%, down from 10% the year before the merger.

The decline in ROIC can be attributed to the expansion of Lance’s balance sheet. Invested capital has grown at 32% compounded annually since the Snyder’s merger and subsequent acquisitions of Baptista’s Bakery, Snack Factory, and distributor Stateline Service Corp. In Snyder’s-Lance, we see a clear case of acquisition’s helping to fuel EPS growth, while destroying the underlying shareholder value.

To quantify this value destruction, the cost of off-balance sheet liabilities and equity capital, costs overlooked in GAAP analysis, was $1.90/share in 2014. After removing this charge we find that economic EPS is -$0.94 vs. GAAP EPS of $2.72 in 2014.

Competitors Are Everywhere and More Profitable

Leave A Comment