Over the past 2 days, I’ve been demonstrating quantitative studies about why the U.S. stock market will probably retest its lows (here and here).

The retest wave is happening right now.

With that being said, here’s why the retest wave probably isn’t over yet (i.e. more short-term selling), but why you should increasingly focus on risk: reward.

*For the sake of reference, here’s the random probability of the U.S. stock market going up on any day, week, or month.

The selloff has been intense

The U.S. stock market’s selloff in the past 2 weeks has been intense. The S&P has only gone up 2 out of the past 10 days, and 3 out of the past 10 days have seen a daily selloff more than -1.4%.

Here’s what happens next to the S&P 500 (historically) when the S&P falls more than -1.4% in 3 out of the past 10 days, while there has been 2 or less “up” days in the past 10 days (i.e. less up days than big down days).

As you can see, the stock market tends to fall even more over the next 1 week.

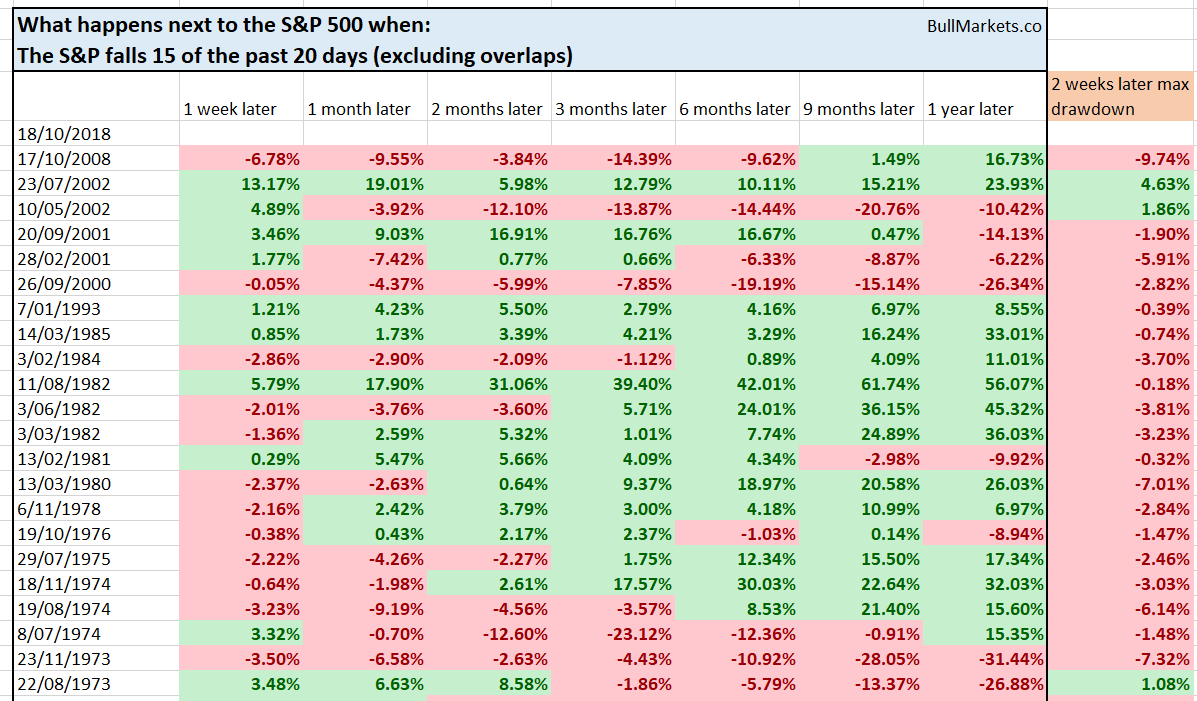

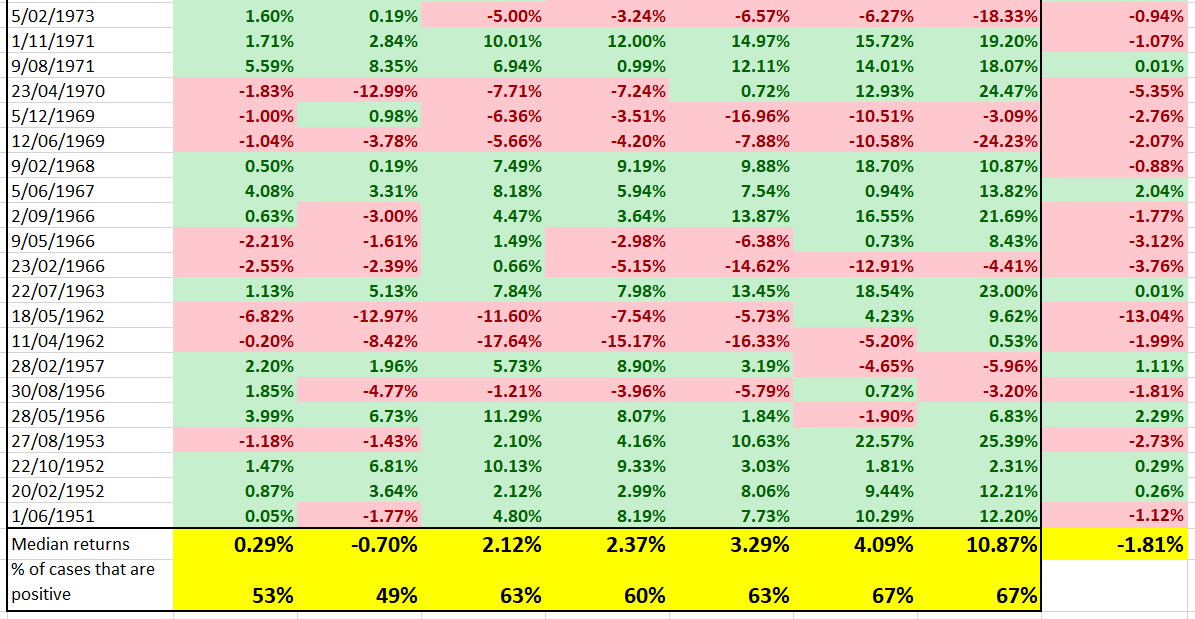

Here’s another way to look at this. The U.S. stock market (S&P 500) has fallen 15 out of the past 20 days. Historically, this led to more choppiness in the next 1 month.

Meanwhile, the Chinese stock market has absolutely crashed. It is now below more than -18% below its 200 dma for the first time in 1 year.

Historically, this meant that:

Are you afraid that the recent Chinese stock market crash will lead to end-of-the-world “contagion” in the U.S.?

When the Chinese stock market crashes as it has now, the U.S. stock market always goes higher in 2-3 months.

Leave A Comment