If you needed a reminder that oil prices can be volatile and are hyper-sensitive to every single data point and/or headline that crosses the wires, you got all the proof you needed last week. And then you got some more evidence on Tuesday when, as we wrote earlier, oil whipsawed as API data clashed with Saudi headline hockey.

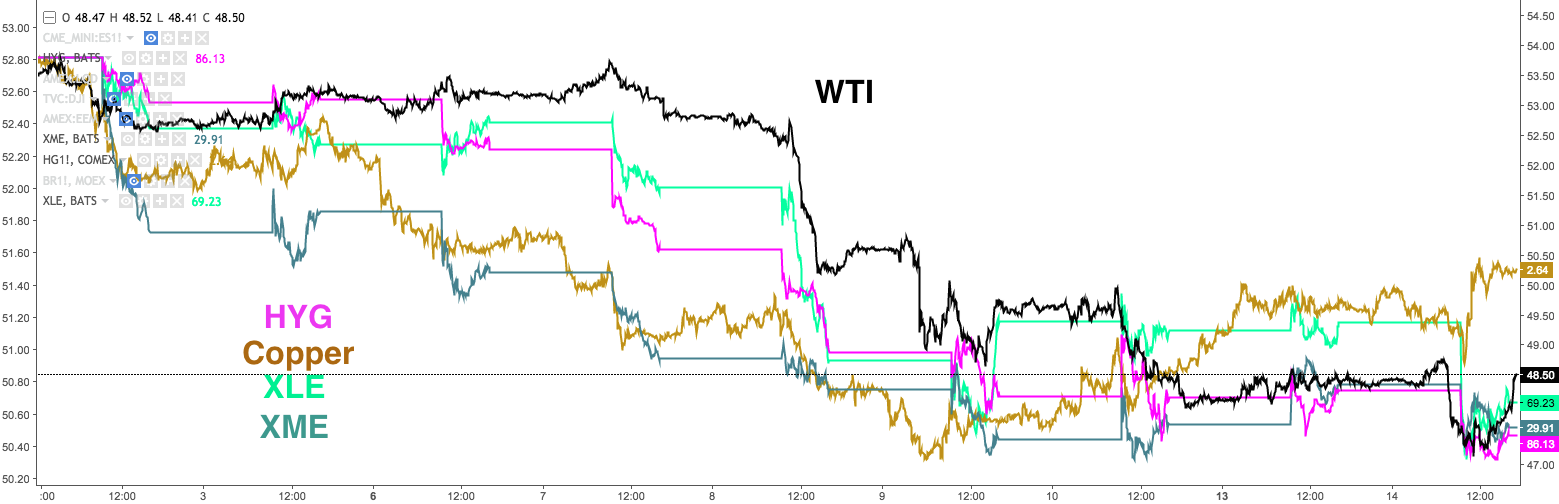

Needless to say, all the drama has had observable knock-on effects for anything commodity-related as HY credit, metals & mining, copper, and energy stocks all sold off in sympathy…

…junk spreads widened…

…and HY’s correlation with crude and copper spiked…

All of this has at least one analyst wary about the outlook going forward. Below, find the latest from Barclays Maneesh Deshpande, who says you might want to consider XLE straddles to capitalize on two-sided risks in the space.

Via Barclays

Leave A Comment