Photo Credit: Mike Mozart

Sonic Corp. (SONC) Consumer Discretionary – Hotels, Restaurants & Leisure | Reports March 29, After Market Closes

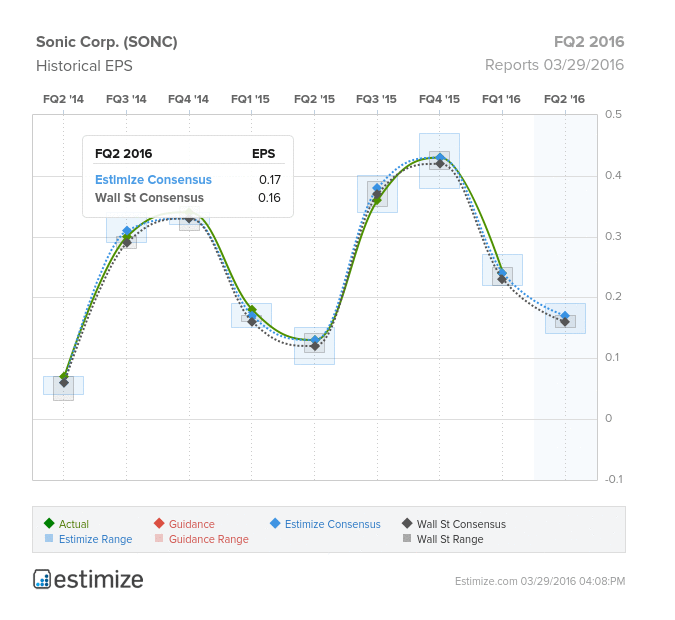

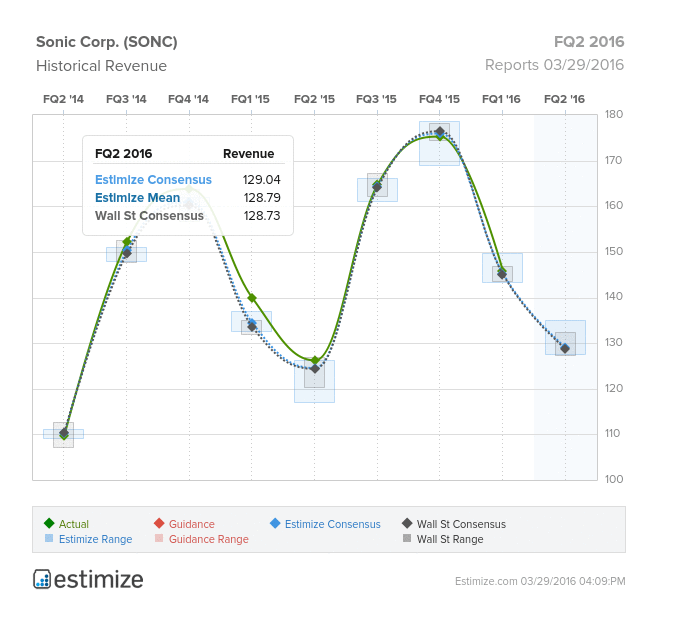

Drive-in burger chain, Sonic, is scheduled to report fiscal second quarter earnings today, after the bell. Its signature business of drink combinations and friendly service by iconic carhops has been widely successful in recent history. Over the past 5 years, Sonic has posted consecutive quarters of positive SSS and EPS growth, with high expectations that they can continue this trend. The Estimize consensus is calling for EPS of $0.17 on $128.79 million in revenue, 1 cent above Wall Street on the bottom line and right in line on the top. This should extend Sonic’s YoY growth, with EPS predicted to grow 30% compared to FQ1 2015. Shares have popped in light of this favorable growth, rising 31.19% in the past 6 months. However, Sonic faces long term concerns predicated on decelerating unit and same store sales growth, with new openings offsetting store closures.

Sonic is coming off a better than expected fiscal quarter during which it beat on both the top and bottom line, consistent with its recent sales traction. The quarter was highlighted with a 5.3% increase in system same store sales, 140 basis point increase in margins and 13 new stores. Same store sales have remained consistently positive despite increased competitor discounting and weak consumer spending habits. Unlike its peers, Sonic has been largely unaffected from McDonald’s new all day breakfast promotion. The company expects its multi layered initiatives to continue to drive earnings for the remainder of fiscal 2016. By the end of the year, investors should see 50 to 60 new franchise openings supporting low single digit same store sales growth and margin improvements. Consequently major banks are bullish on Sonic, reaffirming their buy and hold ratings.

Leave A Comment