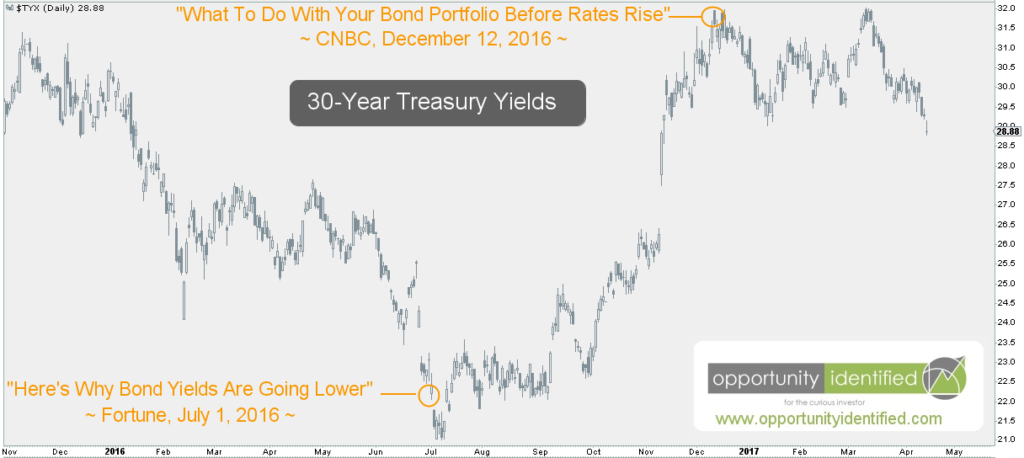

Disbelief is not an investment plan. I have yet to come across a successful investor or trader whose main investment philosophy is solely, “this won’t end well.” We can have all the strong opinions we want, but I’ll let you in on a little secret. Markets don’t care what we think. Markets are going to do what markets are going to do. We cannot bend them to our will. The faster we check our opinions (and pride) at the door and humble ourselves to the all-knowing market forces of supply and demand, the sooner we can begin to profit from objective facts and avoid losses generated by subjective opinions. Over the past few months, a very popular subjective opinion has reached a crescendo: higher rates/yields are all but certain going forward. As usual, this narrative became popular after the objective facts were already in motion. Beginning in July 2016, long bond yields (aka 20+ year U.S. Treasury yields) were rocketing upward as long duration bonds were selling off hard. Only after this move did the media begin touting lower bond prices and higher yields. Prices drive narratives, not the other way around. For example, with a solid bond sell-off already in motion, the financial media informed the investing public that higher yields were all but certain for the foreseeable future. Take a look at their helpful timing below. You can’t make this stuff up.

See how that works? Price first. “News” second. As soon as you realize how this sequential relationship works, the more you’ll be able to filter the “news” you consume. Is there a better way? Absolutely. Study objective facts instead. In other words, study price. It knows more than we do. In this case, the price of bonds knows more than we do. Conversely, yields know more than we do. As a refresher, yields work inversely to bonds. When bond prices rise, their corresponding yields drop.

What does supply and demand for 20+ year Treasuries look like right now? Here’s the weekly chart of TLT, an ETF that does a good job performing similarly to 20+ year Treasuries.

Leave A Comment